-

Get Free Advice

- Become a Seller

Get Free Advice

Found our list of Income Tax Software helpful? We’re here to help you make the right choice and automate your business processes. Let’s discover some of the essential factors that you must consider to make a smarter decision!

Buyers Guide Content

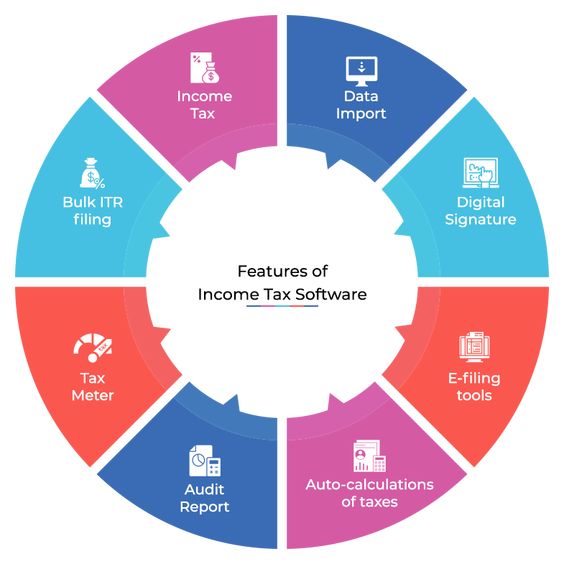

Income Tax Software is a comprehensive solution for Indian tax compliance that automates ITR preparation, TDS returns, and online filing in bulk. It is widely used by CA firms, Law firms, and tax practitioners.

It assists with income tax computation and calculation, filing, and compliance management according to income tax laws. It helps with data entry, return preparation, client management, deadline management, reporting, and more.

IT software facilitates easy preparation and e-filing of ITRs by automatically filling out pre-validated clients' information, income detail, deductions, exemptions, and so on.

Different segments of professions/organizations use income tax software to calculate and track their taxes.

Income tax filing software is designed to help taxpayers correctly and efficiently file their taxes. Most IT software solutions are deployed on-premises, while some are web-based. Here is how ITR filing software works:

CA Firms and tax practitioners can manage file returns by creating multiple client databases.

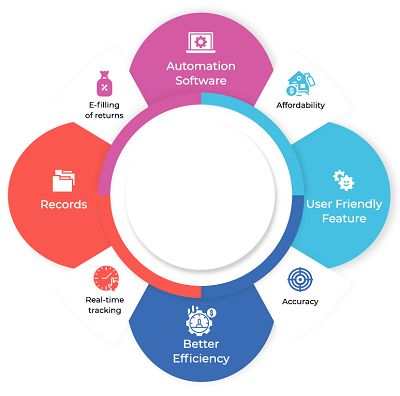

There are a lot of benefits of using taxation software. Be it automation, increase in efficiency or accuracy, bulk filing, or record management. Let's have a look at the benefits of income tax software:

Here is the list of best income tax software for TDS and itr filling

| Top 10 Income Tax Software In India | |||

|---|---|---|---|

| Income Tax Software List | Best for | ||

| EasyOffice | Maintaining database, tax details and returns of Individuals, HUFs, firms | ||

| ClearTax ITR filing software | Filing ITR of all types of entities | ||

| GEN Income Tax | E-filing Tax returns of corporates, Partnership firms, trusts, NPO's | ||

| Saral Income Tax | Bulk filing ITR and generating Bills | ||

| TaxCloud | File income tax and TDS return by uploading Form 16 | ||

| Monarch I-TAX Software | Generating XML files for returns to be uploaded online | ||

| Taxmann | Filing TDS, and IT returns | ||

| Spectrum Complete Tax Solution | Income tax computation and conducting tax audit of small business | ||

| Taxraahi ITR | Filing ITR offline, auto filling 26AS and Form 16 | ||

| Webtel's income tax return filing software | Filing TDS and Income Tax returns | ||

Finding the right taxation software should be based on what your organization needs. Depending on the features and modules you need, your choice of income tax software will change. Here are a few points to consider when choosing an income tax calculation software in India.

Identify your need as if you are looking for particular module-specific income tax software with automated e-filling and a TDS module, or you need complete software with basic features.

Most income tax software are easy to use, but ensure that you can understand and operate the tool easily once it's implemented within your system. Any software functionality that you cannot use conveniently will result in the wastage of both time and effort.

Reliable vendor support is necessary for you in case things go wrong. If you face any issue with the income tax software, you will need a vendor support executive to fix it. You should make sure that your vendor has a reliable after-sales service because delays in fixing the issue can take a major toll on your company.

Before buying income tax software, you should ask for a demo. Also, make sure you inquire the vendor about each feature. ITR software demos are quite helpful, as you can understand the software better and make a sound judgment before buying the software.

Invest only when you are sure you want to opt for offline or online income tax software. Income tax computation software price varies according to its features. If you are a beginner, you can always try your hands on the free income tax software available online.

When you are sure you want to go a step higher, only invest in buying advanced online income tax software. Before buying, always check the minimum system requirement. Also, ensure that the software you choose is compatible with other plug-ins you might want to use.

Author: Kalpana Arya

(Showing 1 - 20 of 44 products)

Still Confused?

By ELECTROCOM

Price On Request

EasyOffice is one of the best taxation software for Income tax Return filing, TDS, & TCS Return preparation, Audit... Read More About EasyOffice

Read EasyOffice Reviews

By ClearTax

Price On Request

ClearTax is an income tax software used by tax experts, vendors, and financial service providers for GST returns filing... Read More About ClearTax Income Tax

Easy to Use Products

By SAG Infotech

Starting Price

₹3,500/Year

GEN is the best Income Tax software has been crafted for the easy calculation of Income, self-assessment, advance tax an... Read More About GEN Income Tax

Starting Price

₹5,500/User

Saral IncomeTax is an innovative income tax software, which allows business owners to calculate and file income tax re... Read More About Saral IncomeTax

An income tax software helps calculate income tax, self assessment tax, advance tax and interest.

Some of the most popular income tax software are EasyOffice, CompuTax, and Cleartax.

Some of the most popular income tax software for ca are EasyOffice, ClearTax, CompuTax, and TaxRaahi.

Time-saving, cost-effective, and high accuracy with minimal errors are a few advantages of using tax filing software.

By ClearTax

Price On Request

TaxCloud India is a web-based ITR and e-TDS software used for filing income tax returns digitally. The software is used... Read More About TaxCloud

Starting Price

₹1,500/Year

Saral TDS is a comprehensive TDS management software. It is developed with a built-in state of the art technology that... Read More About Saral TDS

Read Saral TDS Reviews

By SAG Infotech

Starting Price

₹6,000/Year

GEN Genius is an income tax software designed for tax professionals to manage their clients effectively. The software... Read More About GEN Genius

Read GEN Genius Reviews

Starting Price

₹4,500/Year

I-TAX Income Tax software is one of the full spectrum IT software for Indian companies. It is developed with a bui... Read More About Monarch I-TAX Software

By SAG Infotech

Starting Price

₹3,000/Year

GEN e-TDS software has been exclusively designed for the filing of TDS/TCS returns online as per the norms of TRACES and... Read More About GEN e-TDS

Starting Price

₹8,800

Saral TaxOffice is the most advance and reliable income tax software and audit management software that automates the CA... Read More About Saral TaxOffice

By SAG Infotech

Starting Price

₹5,000/Year

Gen XBRL Software has been developed for professionals like Company Secretaries and Chartered Accountants who are involv... Read More About Gen XBRL

By PDS Infotech

Starting Price

₹4,500/Year

TDSMAN is a comprehensive eTDS & eTCS return preparation software that helps professionals with income tax return,... Read More About TDSMAN

Read TDSMAN Reviews

Starting Price

₹2,750

Income Tax Software ITAX (one Law one Software) is the best audit software in india for filing Indian Income Tax Retur... Read More About Monarch I-TaxNxt

Starting Price

₹2,100/User

eAuditor+ is known as one of the best ITR preparation software that is specially designed for chartered accountants to h... Read More About Monarch eAuditor+

Starting Price

₹2,250Lifetime

M-TDS is an ultimate audit management solutions for preparing of e-TDS/e-TCS return, efilling income tax online, return... Read More About Monarch M-TDS (TDS Management)

Starting Price

₹2,250

Me-TDS is an ultimate solution for preparing of e-TDS / eTCS return, return submission CD and paper Income tax return fi... Read More About Monarch Me-TDS

Price On Request

Site inspection and audit (mAudit) is our successful flagship product for field data collection. mAudit is flexible ITR... Read More About Easyform mAudit

By SAG Infotech

Price On Request

Gen TDS software is the most reliable and user-friendly software which is exclusively designed for filing the TDS/TCS re... Read More About Gen TDS software

By Taxmann

Starting Price

₹18,500

Taxmann’s One Solution is a TDS filing software that helps users generate TDS or TCS returns, along with TDS certific... Read More About Taxmann

By CompuTax

Price On Request

CompuTax is one of the best income tax management and TDS software in India which streamlines daily operations with mu... Read More About CompuTax

Read CompuTax Reviews

Last Updated on : 21 Jun, 2023

Income tax software is basically computer software that helps to calculate tax for any business with easy steps. This software also calculates TDS and avoids errors. It avoids fine charges by sending notifications and you can file your ITR & TDS return in time without any delay.

I'm looking for Income Tax Software that is:

Still Confused?

Get Advice from India’s

Best Software Expert

| Income Tax Software Cost | ||

|---|---|---|

| Best Income Tax Software | Price | Ratings |

| Saral IncomeTax | ₹5500.00 /User | 4.4 |

| Saral TDS | ₹1500.00 /Year | 4.6 |

| GEN Genius | ₹6000.00 /Year | 4.7 |

| Saral TaxOffice | ₹8800.00 | 4.3 |

| TDSMAN | ₹4500.00 /Year | 4.4 |

| Monarch I-TaxNxt | ₹2750.00 | 4.6 |

RK

Rahul Kumar

review for Saral TDS

"Saral TDS comes with a user friendly UI with all easily navigable format. For technical difficulty the live support is available to solve it."

KM

KRISHNAN MLN

review for Saral TaxOffice

"Taxation became so easy with this software. Easy to use, no unnecessary steps to follow."

YK

Yatin Khatri

review for TDSMAN

"Very easy to use software and the PAN verification features are awesome. Highly Recommended!!!"

SB

Saket Bisht

review for Monarch I-TaxNxt

"Monarch income tax software made auditing and taxation easy. I customized this according to business."

SR

Shailesh Ramjatan Yadav

review for CompuTax

"The feature for calculating TDS and CompuBAL is amazing. The software is definitely the best in the field and I would recommend its use to everyone."

GST Software| Expense Management Software| Debt Collection Software| Quoting Software| Pricing Software|

Taxation software is an application for tax preparation, computing, and filing that helps companies, agencies, and individuals with tax-related tasks. It can be used to prepare returns and manage VAT, income, corporate, and service tax.

Taxpayers can easily file ITRs with the income tax utility software offered by the Income Tax Department. The Income Tax Department releases a new version of the ITR Utility software every year.

EasyOffice, ClearTax, Zoho Books and Winman GST are the best software for income tax return filing.

An income tax calculator is an online tool for estimating taxes according to income. Additionally, it calculates relevant ratios and provides automated returns. The software offers bulk verification and generates various MIS reports, including refund status, pending returns, and filed returns.

To use income tax software, follow the instructions. 1. Download and install the IT software or log in from the website. 2. Enter details like PAN number, name, date of birth, etc. of the client or yours. 3. Go to the next page and enter income details from salary, other sources, business or profession, etc. 4. Enter the deductions 6. eVerify the return using Aadhaar OTP, net banking, or by using a digital signature.

Some of the most popular ones are EasyOffice, ClearTax, CompuTax, and TaxRaahi.

Income tax software for Chartered Accountants (CAs) helps in the filing of Income Tax returns for multiple clients. The software maintains all the details, calculations, tax payables, TDS receivables of clients in a single database.

It is not possible to file a TDS return online without the software as you need a file validation utility (FUV) file to upload on the portal. Many Income Tax software solutions have a TDS return module that allows users to create an FUV file.

Best ITR filing Software are EasyOffice, Gen IT Software, Clear Tax, Winman, Saral Tax, Tax Raahi, etc.

15000+

15000+  Best Price

Best Price Free Expert

Free Expert 20 Lacs+

20 Lacs+