TaxBuddy and ClearTax are two different types of income tax software that helps users to easily file returns, calculate TDS, eliminate errors, etc. Both are meant to simplify the task of filing TDS and ITR returns. Moreover, both software can be used for GST return filing also. Despite the common features, there are some highlighting differences between the two. For example, you can file for ITR through video calling with a tax expert with ClearTax which is not available in TaxBuddy. Similarly, AI-based tax planning is offered by TaxBuddy that is not available with ClearTax

Not sure which income tax software is more suitable for your income tax requirements? Here is a detailed comparison of TaxBuddy vs ClearTax with their features, pricing, merits, and other specifications.

Table of Contents

Comparison of TaxBuddy vs ClearTax

The detailed comparison would help you to choose the right income tax software for your ITR needs.

| Metrics | TaxBuddy | ClearTax |

| Best For | ITR filing and tax planning | Income tax e-filing |

| Platform Supported | Web-based and on-premises | Web-based |

| Pricing | INR 499/ year | INR 999/year |

| Support | Email and Call | |

| Live ITR Filing | No | Yes |

| Training | Through documentation | Webinars and videos |

| Integration | Limited | 100+ integrations |

| Target Audience | Taxpayers, salaried employees, businesspersons, professionals, etc. | Salaried employees, tax experts, taxpayers, enterprises, SMEs, etc. |

TaxBuddy vs ClearTax: Detailed Comparison

Here is the detailed comparison of TaxBuddy vs ClearTax in terms of features, supported platforms, specifications, pricing plans, target audience, integration, etc. This comparison will also highlight the merits and demerits of both the software.

ClearTax vs TaxBuddy: In terms of Features

TaxBuddy Features

- Income tax notices management

- Tax advisory

- AI-based tax planning

- ITR and GST filing assistance

- GST compliance & advisory

- Support for TDS, TCS, and ROC filing

Suggested Read: 16 Best Free Income Tax Software for Tax eFiling, IT and TDS Returns

ClearTax Features

- Auto-populates tax data

- ITR-verification

- LIVE ITR filing

- P/L and balance sheet preparation

- Expert tax assistance

- Capital gains transactions

- GST returns application status tracker

ClearTax Vs TaxBuddy: Pricing

TaxBuddy offers different pricing plans for its users. It offers Salary + House Property Plan, Capital Gain Plan, Business Plan / Professional / Freelancers, etc. Each of the plans has a different pricing structure based on the features it offers. Its Salary + House Property Plan starts from INR ₹1,499/ year for users.

However, if you have more than one salaried income and house property, you can buy its advanced plan starting from INR 999/Year. It also offers Capital Gain and Business Plan for its users.

At the same time, ClearTax offers different individual plans to file for returns, TDS on the property’s sale, live income tax filing, etc. It also offers business plans for filing tax returns, filing GST, legal compliance services, etc. Its individual plan starts from INR ₹999 for salaried people.

ClearTax Vs TaxBuddy: Supported Platforms & Specifications

If we talk about ClearTax, it is web-based software, therefore, you can access it from any operating system. It also has a mobile application by the name Black that lets you file for income tax returns by quickly uploading Form 16 and verifying your tax details.

With the app, you can do a lot more than just file returns such as get live chat support with tax experts, secure data with military-grade security, manage all statutory compliances, etc.

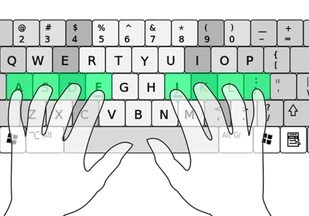

Whereas TaxBuddy is supported on all platforms. You can use its web-based version or download its desktop application. It also offers a mobile application for easy return filing, getting ITR assistance, managing income tax notices, and much more.

ClearTax Vs TaxBuddy: Target Audience / Suitable For

ClearTax is most suitable for tax experts and taxpayers. Tax experts can use it to handle the tax returns of their clients and maximize savings by claiming every input tax credit. It further helps them with GST return filing.

Moreover, taxpayers and SMEs can also use ClearTax to file returns, calculate income tax, get ITR-Verification, etc. from a single solution.

Whereas TaxBuddy is designed for salaried employees, businesspersons, and professionals. It helps them with Income Tax Filing, GST Filing, handling tax notices, etc. TaxBuddy can also be used by SMEs for GST registration, accounting and reporting, assisting with tax planning, and much more.

Suggested Read: Best GST Software for Secure Return Filing and Billing in India

TaxBuddy Vs ClearTax: Available Integration

TaxBuddy offer integration with limited set of business software. However, ClearTax offers integration with 100+ ERP solutions including Oracle Netsuite, MS Navision, SAP, Microsoft Dynamics, etc. This helps to fetch data easily and simplify tasks related to GST, e-invoicing, e-way bills, and much more.

ClearTax vs TaxBuddy: Advantages and Drawbacks

TaxBuddy Advantages

- It lets you easily file ITR with tax experts

- You get free tax planning assistance

- It helps you to reduce your taxes almost by 26%

- You get assistance from tax professionals for GST return filing

- TaxBuddy helps you manage GST and ITR notices.

ClearTax Advantages

- It automatically prefills all the tax data through a single click

- You can file tax returns through the live video call with tax professionals

- ClearTax provides ITR-Verification post e-filing for returns

- It is 128-bit SSI certified to keep your data secure

- You get assistance with complicated tax calculations

TaxBuddy Drawbacks

- No proper follow-ups and slow response to customer issues.

- Data discrepancy might occur

- Keeps on asking for income source when the current window reloads.

ClearTax Drawbacks

- Too much documentation to file for returns

- It becomes difficult to track return filing application status

- Frequent issues with software login.

Which Income Tax Return Filing Software is Better: ClearTax vs TaxBuddy?

The choice for the best income tax return filing software depends on the features you want in that software. However, the detailed comparison of ClearTax vs TaxBuddy would help a lot. If you want software that offers both web-based and on-premises deployment with AI-based Tax Planning, helps calculate TDS and ROC, and manage income tax notices, TaxBuddy is a viable option.

However, if you need web-based software that offers ITR-Verification, like ITR Filing, and expert tax assistance, go for ClearTax.

Related Categories: Income Tax Software | GST Software | Expense Management Software | Debt Collection Software | Pricing Software | Quoting Software

FAQs

- Is ClearTax safe to use?

Yes, ClearTax is completely safe to use for e-return filing, calculating TDS and GST, maximizing tax savings, etc. It uses bank grade network security (128- bit SSL) to keep the data safe and secure.

- What is the alternative for ClearTax?

There are different alternatives to ClearTax that you can use for managing your taxes and filing for ITR. Some of the best options include Avalara, Vertex, ProSeries, TurboTax Business, Lacerte Tax, etc.

- Is ClearTax free?

No, ClearTax is not free, however, it offers a free trial to the ITR return filing plans for individuals, professionals, and enterprises. Its individual plan starts from INR 999 for people with a salaried income along with house rent income.

- Is ClearTax good for ITR?

Yes, ClearTax is a user-friendly software to file for ITR. It prefills all the data to reduce manual data entries, helps with return filing, computes complex tax calculations, etc. Further, ClearTax also helps to file ITR through tax experts.

- What is the best online tax filing site?

You can choose from multiple online tax filing sites for return filing, calculating TDS, auto-populating data in ITR portal, and much more. Some of the best sites for these features are TurboTax, Credit Karma Tax, TaxSlayer, TaxAct, TurboTax, etc.

- What is TaxBuddy app?

TaxBuddy app helps users with ITR filing and reducing the tax liability almost by 26%. Additionally, it assists in GST return filing, income tax notice management, AI-based tax planning, accounting and reporting, etc.

Also Check ClearTax Alternatives on the basis of User Reviews, Pricing, Specifications & Business Requirements!