To complete income tax (IT) payment on earnings, an individual needs to file an IT return (ITR). The document acts as proof that the due income tax is paid.

Filing taxes and tax returns at the end of every financial year can be a problematic and demanding task. Changing government regulations and laws make it even more challenging.

Fortunately, e-filing income taxes with income tax returns (ITR) filing software can ease this task and save your time. Manual efforts are reduced significantly, and chances of error are minimal. Moreover, you can view the records at any time in the software.

16 Best Free Income Tax Software for CA and Tax Professionals in 2023

- EasyOffice

- ClearTax

- Saral Tax

- Winman GST

- EZTax

- TurboTax

- TaxPoint

- TaxSlayer

- H&R Block

- TaxRaahi

- TaxCloudIndia

- TaxAct

- Gen Income Tax Software

- Chartered Club

- LegalRaasta

- CompuTax

There are numerous free and paid IT filing software available in the market for Chartered Accountants (CA) and tax professionals. Some of the best free ITR filing software options are:

EasyOffice

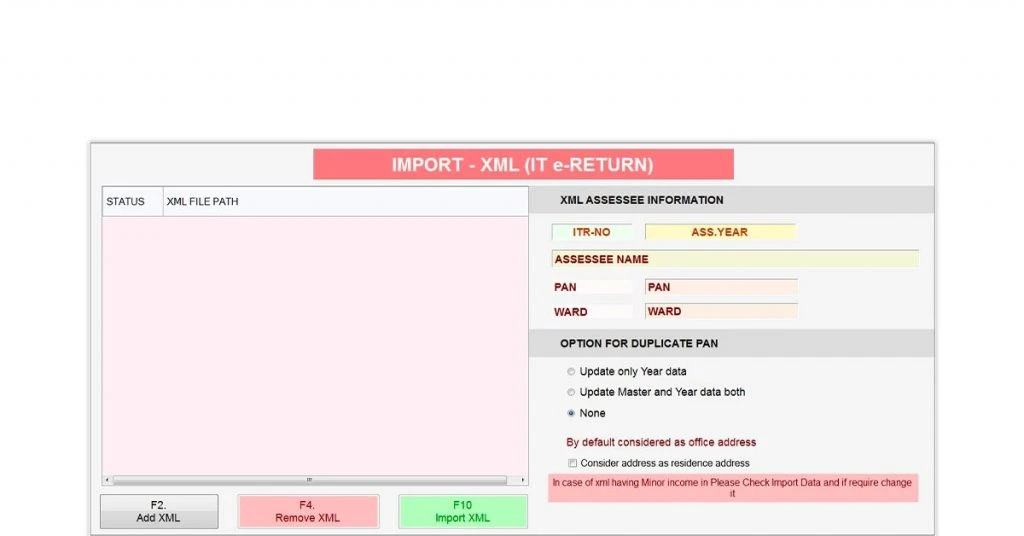

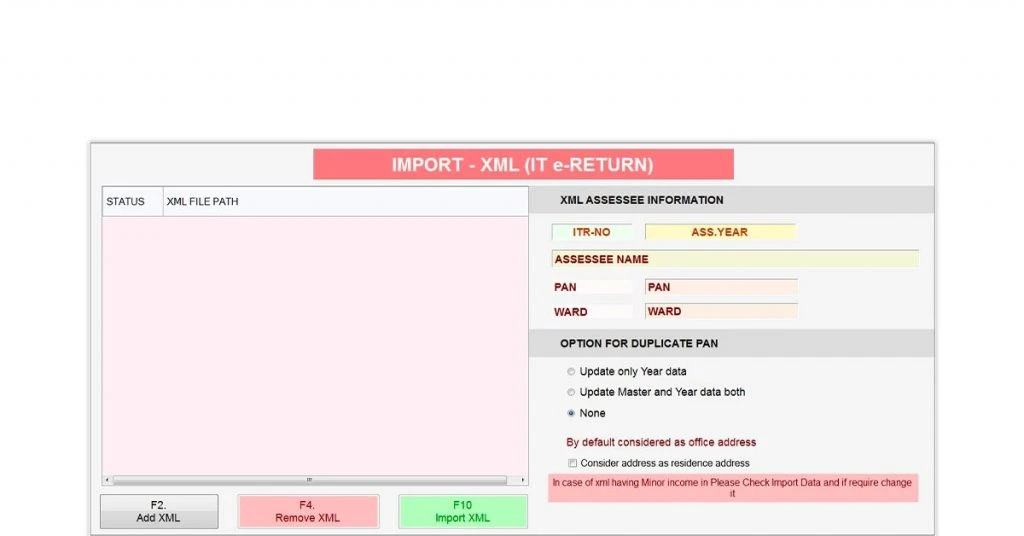

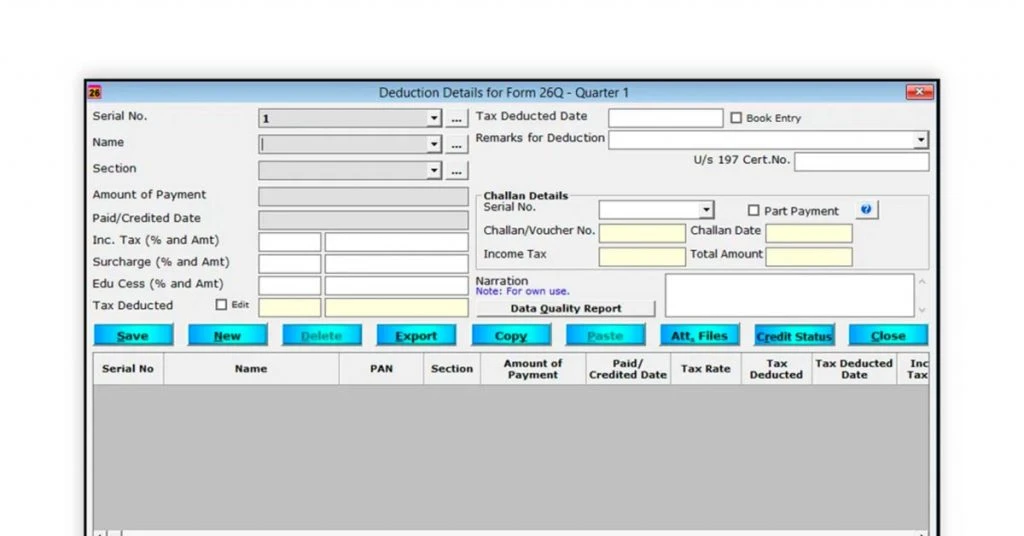

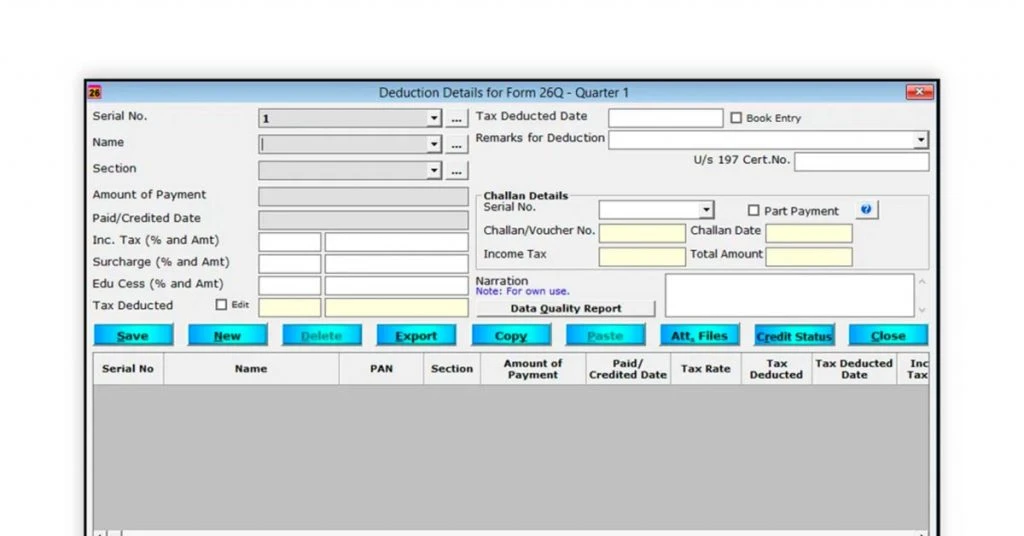

EasyOffice taxation software includes modules for IT returns, audit, CMA, e-TDS, and so on. It has been developed as per the developed IT Department of India, NSDL, and TRACE requirements.

You can get a summary of online income tax computation as well as the previous year’s income tax. It is possible to make direct e-payments and file e-returns via the software. PAN/TAN of users can be verified online. Office management utilities help in saving time.

EasyOffice Features:

- Auto-generation of IT statement

- Can import Form 26AS and data from Tally

- Automatic set off and carry forward of losses

- Autosave of acknowledgment receipt number

- Pre-validation to spot errors in e-return

- Option to view ITR V

- Data transfer from previous financial year

- Option to export/ edit files

Free Trial: Not a Free ITR software, buy free trial available

Pricing: Pricing starts at INR 2400 for the EasyOffice Light combo package that supports 100 users.

Best For: CAs, tax consultants, advocates for different sectors like healthcare, banking, manufacturing, and more.

Pros:

- User-friendly features

- Compliant with government regulations

Cons: No mobile app as of now

ClearTax

ClearTax income tax software enables users to upload Form 16, and ITR gets prepared automatically. You can add income sources, deductions and change details at the time of preview. It’s web-based and allows you to file income tax from anywhere, anytime via an internet connection.

The software provides step-by-step guidance on ITR filing. You also get suggestions for tax savings. Further, also download the report to have complete transparency on tax computations.

ClearTax Income Tax Features:

- Auto import income and tax details from government IT portal

- Multiple Form 16s for job changes

- File returns for multiple years at once

- Save changes and return later

- Prepare revised ITR in case of error

- ITR status tracking

- Supports multiple clients and different income sources

- e-Invoicing

- Expert assistance

- GST calculating and filing

Free Trial: You can try it as a free income tax filing software by creating an account.

ClearTax Pricing: The pricing for individuals starts at INR 799 and 2999 for business users. However, the ClearTax Android app can be downloaded for free. In addition, a free ITR filing option is available for women, senior citizens, and Indian Defense personnel.

Best For: Best free income tax software for chartered accountants, tax practitioners, individuals including NRIs and NREs, and small business owners.

Pros:

- Easy to use

- Can be accessed on the web, desktop, and mobile

- Tax-compliant modules

- Secure with bank-grade network security (128- bit SSL) and security audits

- Screenshot-based tutorials and expert support for queries

Cons: Lacks iOS app for businesses

Saral Tax

Saral Tax software is a tax filing and office automation suite that automates ITR related processes like computation and return preparation. For example, you can view the summary of entered data without scrolling.

This ITR filing software has an in-built module that helps tax professionals manage multiple clients’ data. You can also handle non-client contacts and tasks in the same window. As a result, it is easy to manage billing and receipts, documents, and more.

Saral TaxOffice Features:

- Automates daily office tasks for tax professionals

- Integration with IT Department website for easy update of data

- Bulk filing of ITRs

- Data import/ export for filing Income Tax, audit report, and more

- e-payment of taxes via online payment gateway

- MIS reports for transactional insights

- Tax certificate generation

Free Trial: You can request a demo or get a free trial of the latest software version.

Saral Income Tax Software Price: Saral income tax software pricing starts at ₹5,500, and Saral Tax Office pricing starts at ₹8,800 for a single user.

Best For: Free income tax software for chartered accountants, tax professionals, small business owners.

Pros:

- Easy to understand workflows with a user-friendly UI

- Security of data

- Ensures compliance

- Prevents data entry duplication with interrelated modules like IT and audit reports

Cons:

- No cloud support, desktop-based only

- Mobile app only for accounting and billing functions

Winman GST

Winman GST suite consists of IT software, audit report software, balance sheet software, etc. The software focuses on income tax preparation and tax filing procedures.

It also helps with the generation of GST Returns as per the regulations of the Indian IT department. So, for example, you can generate GSTR-3B, CMP-8, GSTR-1 and get annual returns in GSTR-9, GSTR-9A, GSTR-9C, and GSTR-4.

Winman GST Software Features:

- Automatic filing of data from balance/computation sheet

- Points out errors to ensure accurate e-filing of ITR

- Automatically connect to IT department upload page

- Can import trial balance from Tally in a click

- Track e-return processing status with one click

- Import of data from 26AS form

- Automatic download and save of ITR V

- MIS Reports

Free Trial: 30 Days

Winman GST Software Price: Winman GST price available on request at techjockey.com.

Best For: CAs, accounting professionals, tax professionals, small business owners.

Pros:

- User friendly, everything in a single window

- Easy access to GSTR instructions and portal

- Deduplication check

- Password security

- Instant support

Cons: No mobile app, only on Windows PC

Suggested Read: How to file GSTR 1 using Tally

EZTax

EZTax free ITR filing software helps with income tax e-filing, TDS preparation, GST accounting, among other services. It enables users to e-file ITR on their own online.

They can also ask for expert assistance at any stage of ITR e-Filing. For CAs and other tax practitioners, this income tax filing software provides the option of bulk e-filing.

EZTax income tax return filing software can create a complex what-if scenario in real-time to display the current refund and possible refund after saving recommendations.

EZTax Features:

- Client manager to manage all clients from one screen

- Real-time Tax Calculation

- Express Filing to file taxes based on questions

- Auto reads uploaded Form-16, Form 26AS

- Change salary information in case of switching jobs

- Tax Optimizer to save on taxes and increase ROI

- Creative Audit to avoid IT notices in future

- Download customized ITR report

Free Trial: NA

Pricing: Online self-service with this free income tax filing software is available for free. Expert-assisted filing starts at INR 599.

Best For: For individuals, CA, ICWA, TRP, CMA

Pros:

- Error-free ITR

- Address validation

- Works online

- Support via chat, call, email

- Secure File Manager for documents uses an Indian data center

Cons: No separate application for iOS and Mac users.

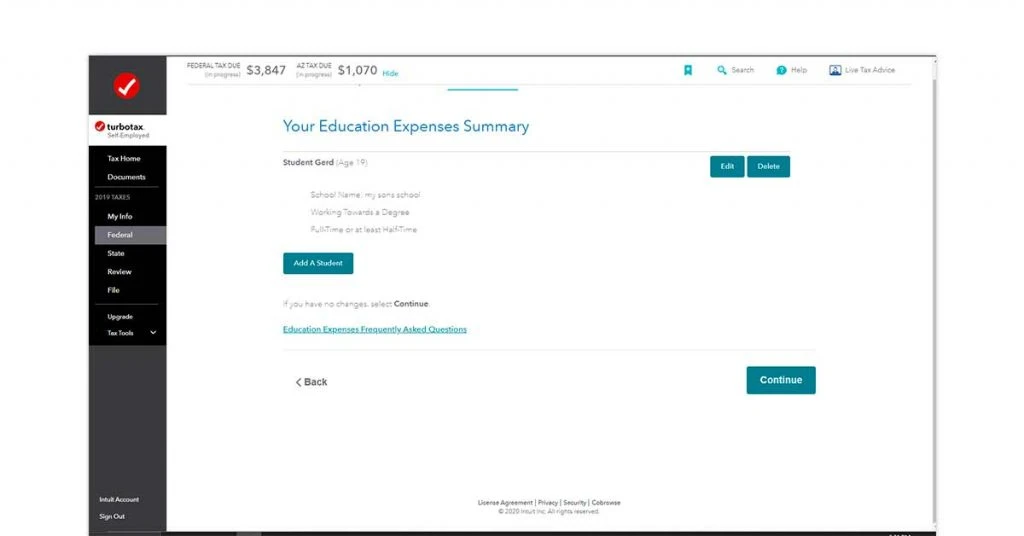

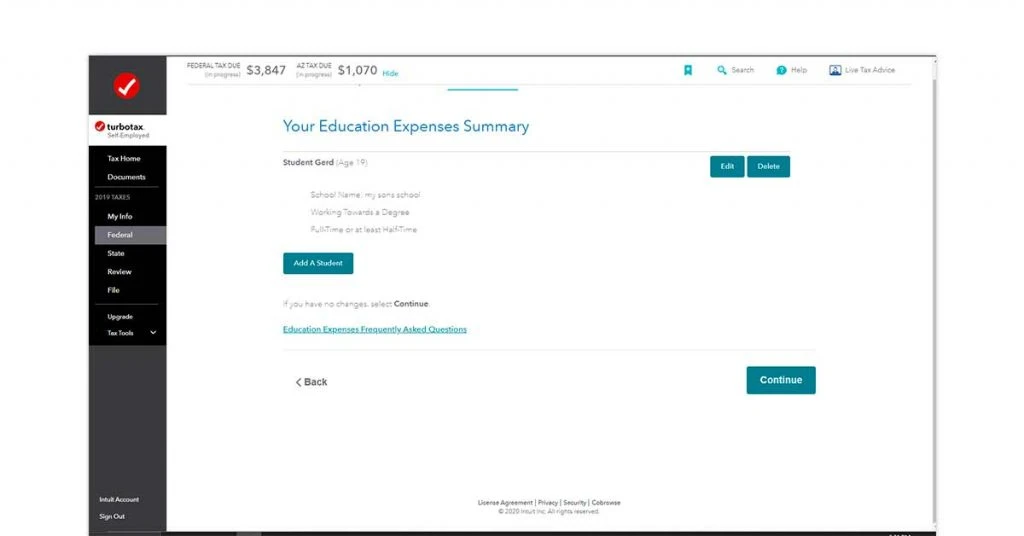

TurboTax

TurboTax ITR filing software free allows users to file their taxes based on their answers to the questionnaire. It imports all the data from W-2 into relevant forms. If you are a US nonresident living in the US, you can still use it.

You can also get the help of a live or dedicated expert. Based on your documents, you get matched with the tax expert suitable for you. Experts can answer any queries and explain everything about a return. Of course, they can file your returns too.

TurboTax Features:

- Complete review of a tax return to avoid missing anything

- Can search 350+ tax deductions

- Expense estimator

- Tax bracket calculator

- Audit support from a tax professional

- Documents checklist

- Helps in finding changes in tax deductions and credits

- Email confirmation on tax acceptance

Free Trial: NA

TurboTax Price: You can start it as a free income tax return filing software and pay only when you file your taxes. Tax calculators are available for free.

Best For: Tax experts, CPAs, small business owners, and startups

Pros:

- Accurate tax calculations to avoid penalties

- Security with multi-factor authentication and Touch ID

- Mobile apps for both Android and iOS

- Archives your past ITR returns filing

- Customer support

Cons: More features are required for complex financial situations

TaxPoint

TaxPoint offers its customers a wide range of services, including assistance on taxation matters, business advisory, and financial advisory. This Indian income tax computation software auto-populates the necessary data into the fields when you file returns.

Once you file your taxes with TaxPoint ITR software, you can directly transfer all necessary information for next year’s returns. Contracts and other legal data can also be reviewed for tax considerations.

TaxPoint Features:

- Import return data from another online tax prep service

- Tax calculator

- Import W-2 data easily

- Quick refunds and rewards

- International/Local tax planning and compliance

- GST compliance

Free Trial: NA

Pricing: It’s a free income tax filing software

Best For: Tax professionals, accounting professionals, beginners

Pros:

- User-friendly interface

- Customized services, error checking

- Bilingual

- Support via email, phone, live chat

Cons: Filing state returns is not free

Suggested Read: 10 Important Changes Taxpayers Should Consider in New Financial Year 21-22

TaxSlayer

TaxSlayer ensures that taxpayers can maximize the refund as per their income. You can check for errors and missing data before e-filing. After the return is submitted, users get notified once the IRS portal accepts tax returns.

Calculations of the software are always up to date. In addition, integrated bank products help in deducting tax prep fees from refunds so that clients get paid faster.

TaxSlayer Features:

- Client portal

- Import data from another tax service of prior year return

- Tax refund calculator

- Autofill income and wages

- Import W-2 Income

- Covers student loan interest and education expenses

- Year over Year comparisons

Free Trial: NA

Pricing: It is a free income tax return software for simple tax filing (taxable income is low) and includes free state and federal returns. It is also free for military members with an active military EIN.

Best For: Tax professionals, individuals like contractors, 1099ers, freelancers

Pros:

- File ITR from any device

- Regular update on tax laws for accuracy

- Support via phone, email

- Safety and security of tax data via multi-layer authentication

- Bilingual support

Cons: Support service can get better

H&R Block

H&R Block simplifies e-filing tax returns by providing customized tax prep options. It offers questions to help users file their taxes. In addition, you can store returns, receipts, donations, and other tax documents for easy access. You can also file form 1040 and Schedules 1-6.

You can import federal filing data for state taxes calculation. In addition, it can help file local taxes in the US, Canada, Australia, India, Puerto Rico, and Guam report.

H&R Block Online Features:

- Personalized tax organizer

- Tax calculator

- Import W-2 data by simply a picture

- Upload last year’s return from TurboTax, Quicken, etc.

- Ensures correct credits, including EIC

- Track return in real-time

- Refund results in real-time

Free Trial: NA

Pricing: This is a free income tax return filing software for online tax filing. Professional services are paid.

Best For: Small business owners, retired individuals, students. Expert assistance from CPAs and other agents.

Pros:

- Multiple safety layers

- In-person audit support

- 24*7 chat support

Cons: Additional state fees for features like Audit support

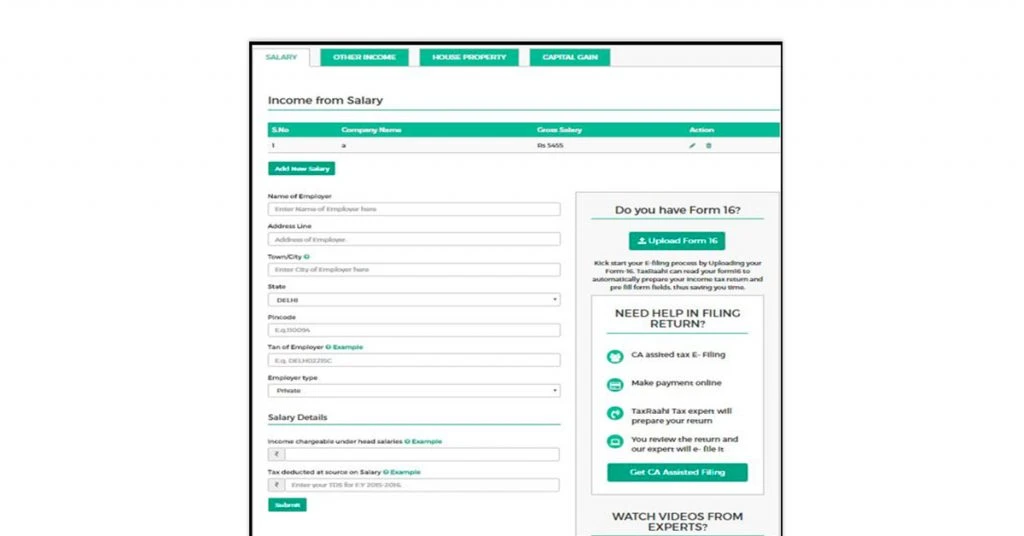

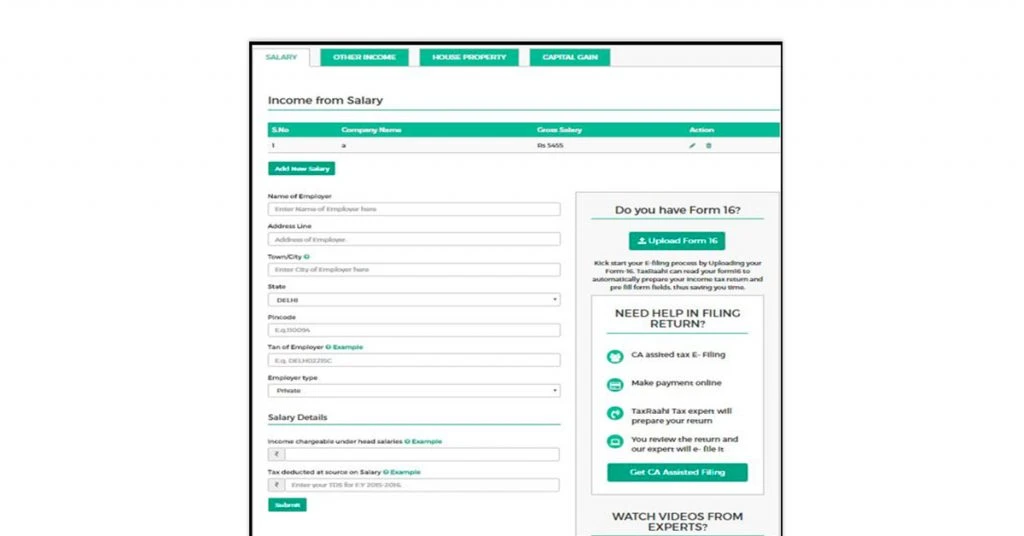

TaxRaahi

TaxRaahi is a user-friendly taxation software for ITR, TDS, and GST filing. It does not require digital signature certificates (DSC) and tax filing is quite fast.

To ensure correct taxes and deductions, you can calculate income from salary, house property, capital gain, PGBP, and other sources. TaxRaahi ITR follows IT department guidelines to prepare and file returns in ITR 1, ITR 2, ITR 3, ITR 4, and ITR 4S.

Tax Raahi Features:

- View client’s previous return

- Automatic tax computation

- Previous year return import

- Form 16 & 26AS import

- Capital gain calculation

- Store all data at one place

- Can revise returns

- Refund tracking

Free Trial: NA

Pricing: With this free income tax return software, you can easily file ITR. For expert assistance, pricing starts at INR 471 for a basic package.

Best For: Free income tax software for chartered accountants, tax professionals, accounting professionals, individuals, companies.

Pros:

- Cloud-based

- Easy to use

- Security

- No IT login password needed

- Accuracy

- Support via phone, chat

Cons: Does not have a mobile app

TaxCloudIndia

TaxCloud India tax solution automates different tasks during tax filing to save manual efforts. It supports all forms from ITR 1 to ITR 6 and various income sources like salary, property sale, and more.

You can be up to date with the latest tax regulations. In addition, tax professionals can use parallel login so that team members can work on the same client simultaneously.

TaxCloudIndia Income Tax Features:

- Bulk add clients via XML

- Instant clientele overview to choose a client

- Can drag-drop several Form-16s

- 26AS form fetch from government portal in one click

- Automatic validation of all entries

- Zerodha, CAMs, Karvy integrations for capital gains of clients

Free Trial: 30 days

Pricing: The software is available for a 30-day trial as free Indian income tax computation software.

Best For: Free income tax software for chartered accountants, tax professionals like tax consultants, tax return preparers, lawyers.

Pros:

- Cloud-based

- e-verification of returns

- Security of passwords by saving them in local machine

- Privacy

Cons:

- Setup takes time

- Lacks support

Suggested Read: TaxBuddy vs ClearTax: Detailed Comparison of Income Tax Software

TaxAct

TaxAct income tax software supports different types of income status, including retirement, W-2, child tax credits, EIC, and more. Expenses of dependents and full-time students are also covered. You can file the 1040 form and state return as well.

More expenses and income options are covered in paid options. You also get a notification when IRS & state are done with the processing of your returns.

TaxAct Features:

- Previous year return import

- Import W-2 data

- Personalized TaxPlan for refund boosting opportunities

- Deduction maximizer

- ProTips service for better tax outcome

- Can calculate depreciation

- IRS refund tracking

Free Trial: NA

Pricing: Free ITR software is available for simple filers or those unemployed, dependent, or retired. You can file complex returns and get help with its paid versions.

Best For: Individuals, CPAs, EAs, and tax experts

Pros:

- Intuitive interface

- Account and technical support

- Mobile apps for Android and iOS

- Security

Cons: Limited features with free ITR software version

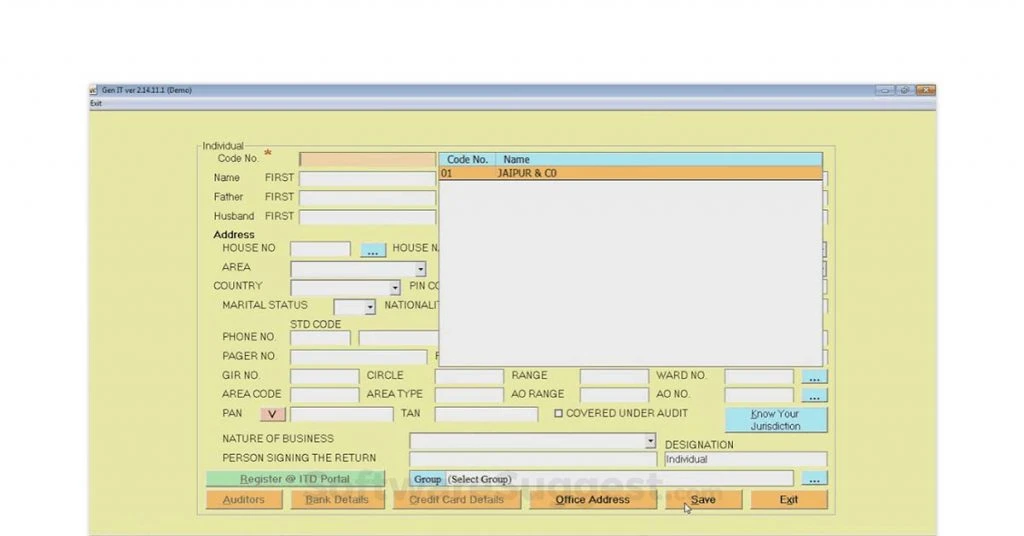

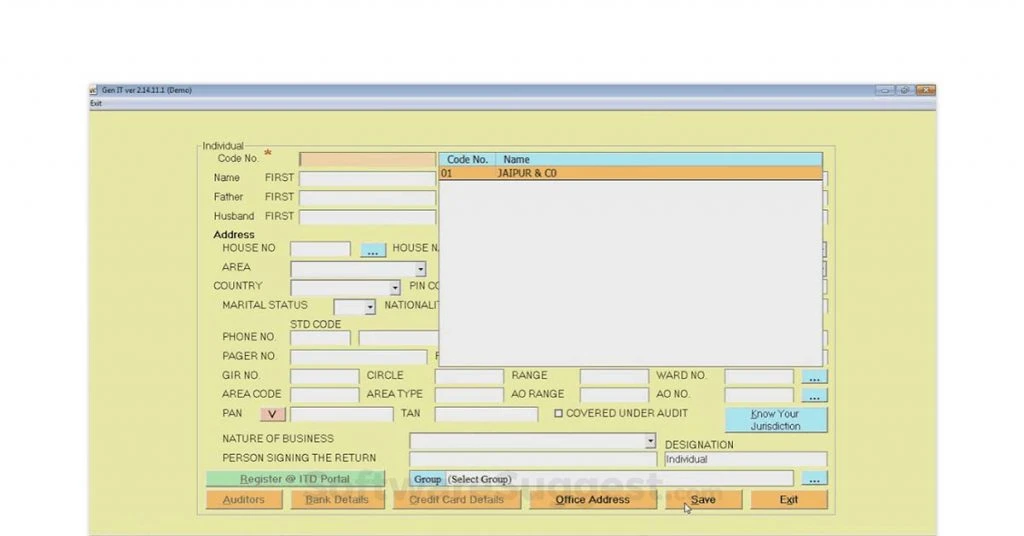

Gen Income Tax Software

Gen Income Tax Software enables e-filing to upload returns directly. You can compute income tax, advance tax, self-assessment tax, and interest. Gen IT includes a wide range of provisions like chapter VIA deductions, setoff losses, arrears, and so on.

You can e-file ITR Forms 1,2,3,4,5,6 and 7. Losses, KVP, and NSC data is automatically carried to the next year from the previous year.

Gen Income Tax Software Features:

- Automatic return form generation

- Import data from any tax software in XML

- Bulk e-filing and verification

- IT department web-service for easy upload

- MIS reports like pending returns, refund status, etc.

- PAN correction/ online submission

- Reverse tax calculator

- MAT/AMT computations

- IT portal linking

- Interest calculation

Free Trial: It is a free Indian income tax computation software.

Pricing: Software pricing is INR 5900 per year at Techjockey. For more details, please contact our sales team.

Best For: CAs, tax professionals, legal/ law firms

Pros:

- Error free

- Compliant

- Mobile app

Cons: Better Android support than iOS

Chartered Club

Chartered Club by CA Karan Batra is a platform for users to book an appointment and consult for ITR filing. You can discuss your case both remotely and in person.

Once you share the necessary documents, you receive the draft computation of your tax liability. The focus is on reducing your tax liability. If you approve it, your ITR will be filed. TDS certificate facility for NRIs is also available.

Chartered Club Features:

- Includes income sources like salary income, rental income, interest income, and capital gains

- Tax advisory before filing

- Tax computations

- Review before filing

- Consultancy throughout the year

Free Trial: NA

Pricing: You can get 30 percent off on your first tax consultation appointment. Chartered Club ITR filing service costs INR 9700, of which only 20% needs to be paid in advance.

Best For: Individuals

Pros:

- Telephonic support

- Book an appointment at your comfort

- Face to face discussions

- Customized services

Cons:

- Not for business income with Books of Accounts, P&L and Balance Sheet

- Lacks mobile app

LegalRaasta

LegalRaasta income tax software offers simplified solutions for handling issues related to legal compliance. The software is an e-filing intermediary to be found on the income tax department’s catalogue.

The tax software ensures accurate calculations for e-filing the returns and verifying the data. LegalRaasta is TDS and GST compliant for managing the goods and services tax for individuals and businesses.

LegalRaasta Features:

- Document management for storing tax documents

- Tax filing, liaison, refund assessment & rectification

- High-level encryption and automated backups

- Trademark and patent registration

- Reliable data backups for filing business income and tax returns

- Easy data import from TDS and data files

- Automated TAN and PAN verifications

- TDS computation and OLTAS linking

- FVU format for filing returns

Free Trial: NA

LegalRaasta Pricing: ₹ 668 is the yearly subscription cost of accessing LegalRaasta. More details are available on request.

Best For: Lawyers, small business owners, CAs, start-ups, CS, and accounting professionals.

Pros:

- Supportive customer services

- Easy GST filing

- Quick support for registering new trademarks

- Excellent documentation support

Cons: No services for FSSAI support

CompuTax

CompuTax is the ideal software for filing computerized tax returns as well as automating tax-related tasks. The software provides different types of DSC (digital signature certificates). CompuTax online also supports auto-download for ITR 5 along with a locator for identifying errors in e-returns.

CompuTax Features:

- Online e-return filing

- DSC registration and bulk refund status

- Data viewing and import form 26AS

- You can add CAs and approve audit reports

- Auto pick intimations and communications

- Linking PAN with Aadhar and generating EVC

- Electronic verification of returns through EVC and Aadhar OTP

Free Trial: NA

CompuTax Pricing: Price details are available with the vendor on request.

Best For: Small businesses, tax professionals, administration and sales executives, CAs and finance managers.

Pros:

- Trained technical staff helps with troubleshooting issues

- Best for maintaining taxation database

- Task automation helps reduce the compliance burden

- Data backups created on the cloud

Cons: Customized reports not available

What is ITR Form?

ITR form is essentially a tax form used to file income tax with the Income Tax Department. Taxpayers file all information about their income and applicable taxes in the ITR form. For now, the income tax department has notified seven ITR forms mainly ITR 1, ITR 2, ITR 3, ITR 4, ITR 5, ITR 6 and ITR 7.

The law requires all taxpayers to file income tax returns annually. ITR is filed against the income businesses or individuals generate during a given assessment year through all sources such as regular income, dividends, interest, capital gains, etc. Taxpayers must file their returns within the specified date, which is July, 31 for this year.

In case the tax return shows that a taxpayer has paid excess tax during a given year, the taxpayer/assesses is eligible for a tax refund based on the department’s calculations.

The taxpayer’s sources and amount of income along with his/her income category (individual, business, etc.) decide which ITR form they are eligible to fill.

Identify the Suitable ITR Form

A significant step towards filing income tax return is to identify the tax return form that is applicable for an individual taxpayer, as below:

# ITR-1 (SAHAJ)

- Resident and ordinarily resident (ROR) individuals with total income of ₹50 lakh and below,

- Having salaried income,

- Owning a residential property,

- Agricultural income up to ₹5,000,

- Income from other sources,

- Despite their source or quantum of income, non-residents cannot file ITR-1.

# ITR-2

Individuals who do not have income from profits and gains of business or profession (who cannot use ITR-1) can use ITR-2.

# ITR-3

This is apt for individuals who have an income from profits and gains of profession or business.

# ITR-4(SUGAM)

- It is suited for individuals, and firms (other than LLPs) that are residents,

- have total income ₹50 lakh and below

- have income from business and profession computed under the presumptive taxation scheme.

Conclusion

Selection of software should be made on work requirement. If an unpaid software has the features you need, consider choosing that. Get trained on all features of the software you choose if you want its best use. It will prevent bad outcomes.

Above all, the ITR forms for the assessment year 2021-2022 have been revised. It is a mandate for everyone to understand the new form requirements before filing their income tax return. Be very careful while filling your forms to avoid any complications or legal implications.

- What is the last day of income tax return filing in 2021?

Income Tax Return (ITR) Filing the last date is September 30, 2021.

- What are the advance tax due dates in 2021?

In the financial year 2021, you must pay 15% of tax liability by 15th June every year, 45% by 15th September, 75% by 15th December, and 100% on or before 15th March.

- Which versions of ITR utilities are supported in the FY 2021-22?

In FY 2021-22, a common offline utility for filing income-tax returns ITR 1, ITR 2, ITR 3, and ITR 4 is available. In addition, a common offline utility for filing Income-tax returns ITR 5, ITR 6, and ITR 7 for the FY 2021-22 will be available soon.

Related Categories: GST Software | Expense Management Software | Income Tax Software | Debt Collection Software