-

Get Free Advice

- Become a Seller

Get Free Advice

Calculated Price (Exclusive of all taxes)

₹ 18500We make it happen! Get your hands on the best solution based on your needs.

Manage TDS

Users can generate TDS or TCS returns with Taxmann’s One Solution as well as deposit challans and even generate TDS

TDS Return in Advance

Users can file TDS returns in advance and even generate returns with Default Predictor Notice to check the defaults before

Customized report/MIS

Taxmann’s One Solution enables users to create customised TDS reports and other MIS reports of their desired form, financial

Auto calculation of TDS, TCS

Taxmann comes with both auto and manual calculation of TDS or TCS for the deduction entries.

Tax Audit

Taxmann comes with a Tax Audit Manual that provides users with detailed information and guidance on income tax audit as per

Income Tax Return

Users can file income tax returns by creating a common master for ITR, TDS and Audit.

Tax Management / GST

The software calculates tax automatically and enables users to manage GST returns. It even provides updates on the latest GST

Excel import and export for deductee master

Users can import deduction entries and employee/deductee master directly from Excel and can even export these data in their

Import challan from OLTAS and auto-mapping

With Taxmann, users can import challans directly from OLTAS (either for single or multiple verifications), without having to add

Q. Can I migrate my data from the current software to Taxmann’s One Solution software?

Q. What are the steps for using One Solution TDS software?

Q. Can I import data through Excel in Taxmann’s One Solution?

Q. Can I have multi-user access in Taxmann’s One Solution?

Q. Can I add new roles to Taxmann’s One Solution?

Q. How do I migrate TDS Master to Taxmann’s One Solution?

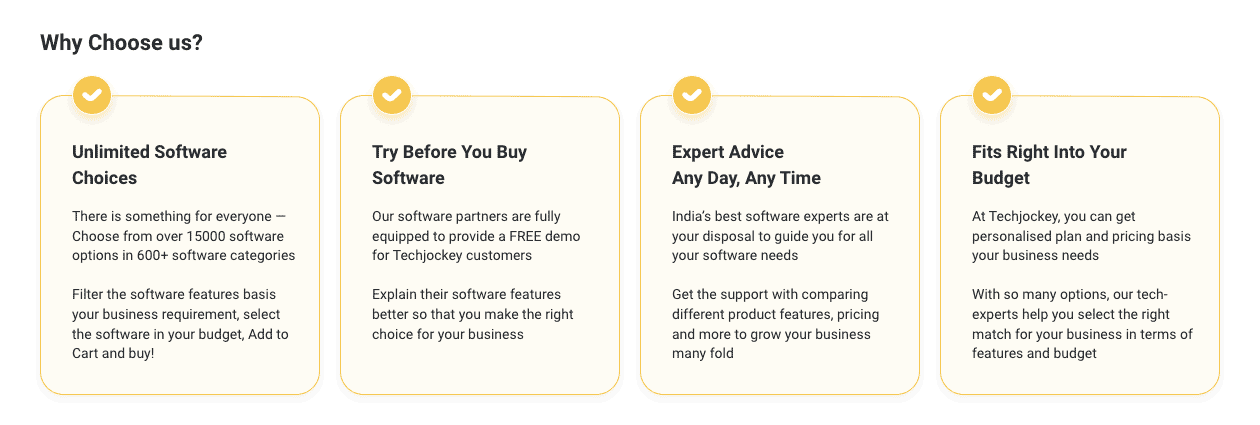

15000+

15000+  Best Price

Best Price Free Expert

Free Expert 20 Lacs+

20 Lacs+