As more businesses are making their presence felt online, seamless user experience has acquired a new meaning. A major step in this direction has been the advent of payment gateways which make online shopping all the more convenient for customers.

Sadly, payment gateways are now the prime target of scammers for online fraud. According to a financial express report, online fraud cases in Indian ecommerce industry have seen a jump of almost 500% between 2016-2019. This is bad news especially for new players entering the market who seem to be like a deer caught in headlights with payment gateway integration.

If ecommerce firms want to maintain trust of customers in online payment portals, it is imperative that they shield the customers from such frauds as much as possible.

It has also been observed that a major factor for people to abandon their purchases midway has been a lack of options in free payment gateways.

Now the question arises how businesses can ensure that transactions on their websites are secure without compromising on the overall convenience. For that, we need to understand what the term payment gateway means and what goes behind making it work.

What is a Payment Gateway and How It Works?

Think of a payment gateway as a cash register, albeit the one that works electronically. Payment gateways are services that streamline online payment methods including payments made through credit or debit card for ecommerce websites. Some of the popular payment gateway providers are PayPal, RazorPay, Cashfree etc.

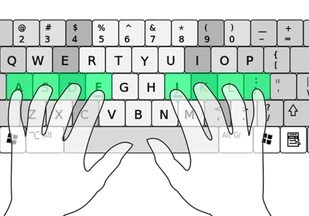

Generally, a payment gateway works in the following way:

- Encryption is established between user’s browser and purchase site’s server which encodes data exchange between the two end points.

- Payment processor raises a request of authorization after it receives a green light from a financial institution such as the user’s bank to move ahead with the transaction.

- The user authorizes the payment, confirming that is them making the purchase, allowing the retail site to receive payment.

Payment Gateway List: Examples of Top Payment Gateways in 2020 for Your Business

- Paytm Payment Gateway

- CCAvenue Payment Gateway

- HDFC Billdesk

- Billdesk SBI

- Paynimo

- Stripe Payment Gateway

- Cashfree Payment Gateway

- PayPal Payment Gateway

- PayUbiz Payment Gateway

- RazorPay Payment Gateway

- Atom Payment Gateway

- Instamojo Payment Gateway

Depending on the level of security offered and the ease in making payments, a business can choose from several top payment gateways in 2020. Here we list some of best Indian and international payment gateways, which upcoming businesses can use to provide an enhanced user experience.

Top E-commerce Payment Gateways

Paytm Payment Gateway

Paytm Payment Gateway comes with a safe and PCI compliant way to provide fast speed transactions which are not only limited to credit/debit cards but also extends to net banking, UPI and Paytm wallet. Paytm payment gateway comes with the option of free account setup and no maintenance charge.

USP: Paytm has been able to create its presence among the smallest vendors and the masses. With the help of Verisign-certified SSL encryption technology, Paytm has revolutionized the process of online payment in India.

Processing Fee-

| Mode of payment | Charges |

| UPI | 0% |

| Paytm Payment bank | 1.99% + GST |

| Paytm wallet | 1.99% + GST |

| Credit Card | 1.99% + GST |

| Debit Card (RuPay) | 0% |

| Debit Card (Visa, Mastercard) | 0.4% + GST (for transaction amount <= 2000) 0.9% + GST (for transaction amount > 2000) |

| Net banking | 1.99% + GST |

Cashfree Payment Gateway

Cashfree payment gateway supports one of the widest ranges of Pay later options, which means that users can pay for their purchases in installments over a period.

Cashfree, through its Cashgram facility, allows for even COD refunds to be initiated and processed. Using cashfree refund API, customers can check the status of their refund on cashfree dashboard.

You can block the funds once an order is placed on the site. In case of a cancellation, you can refund the amount without any cancellation charges applying.

USP: Cashfree is the only online payment gateway in India with a T+1 cycle. That is payment is credited to your bank account one day after it is initiated.

Processing Fee-

| Mode of payment | Charges |

| Debit card | 1.75% |

| Credit card | 1.75% |

| UPI | 1.75% |

| Netbanking | 1.75% |

| Cardless EMI | 2.5% |

| International cards | 3.5%+ Rs. 7 per transaction |

| Paytm/PayPal | Standard payment gateway charges applicable |

| American express card | 2.95% |

RazorPay Payment Gateway

Razorpay payment gateway comes with a hassle-free setup. Within minutes of registering your business, you can go live and start taking payments through payment gateways, payment links, payment pages, SmartCollect and subscriptions.

RazorPay further ensures instant refunds through payment gateways. This online payment gateway boasts of some of the robust and developer friendly APIs, plugins and libraries which all contribute to create a seamless experience.

USP: Some of its unique features are instant activation within two minutes and 100 plus payment modes.

Processing Fee–

- Standard plan- No setup or maintenance fee

| Mode of payment | Charges |

| Indian credit card, debit card, net banking, UPI wallet, | 2% |

| American express cards, international cards | 3% |

- Enterprise plan– Custom price list is available on request. Visit official website for more information.

Payment Gateways for Mobile Apps

Atom Payment Gateway

Atom payment gateway provides impeccable service both to new as well as established businesses as it is integrated with several banks and payment options. This Payment gateway makes use of PCI DSS version 3.2, and 256 bit encryption to provide secure transactions and fast checkout.

USP: What makes Atom one of the best payment gateways is its dynamic routing. That is, if a bank router fails on one gateway, the transaction shifts to another gateway, preventing failure.

Processing Fee-

| Modes of payment | Charges |

| Credit card (domestic) | 1.99% + Rs. 3 |

| Debit card | 0.9% |

| Net banking | 1.99% + Rs.3 |

| Wallets | 2.2% |

| Bank EMIs | Available on request |

| Bank’s IMPS | 1.8% |

| American express card | 3.95% |

| Credit card (international) | 3.95% |

Instamojo Payment Gateway

Instamojo payment gateway is made for small businesses and entrepreneurs to facilitate online selling and payments. Instamojo allows sellers to send payment requests via SMS. Instamojo is a hit among the artists who use the platform to sell their designs, photographs, books etc.

USP: Instamojo provides the option of an embed button, which can be pasted on blogs or sites for instant collection of payment.

Processing Fee-

| Modes of payment | Charges |

| NEFT/ Bank transfer | No charge |

| UPI, Net banking, debit cards, credit cards, wallets | 2% + Rs. 3 (exclusive GST) |

| International cards, AMEX cards | 3% + Rs. 3 (exclusive GST) |

Payment Gateways for International Transactions Online

PayPal Payment Gateway

Arguably one of the most widely known payment gateway options in the world, PayPal’s Payflow offers an unparalleled user experience. Payflow works seamlessly with almost all merchant sites and accounts.

Businesses can also aim for a better sales prospect by offering online payment gateway options like PayPAl on their site as it is one of the most used online payment modes worldwide.

USP: Merchants who want to provide customers with a better checkout experience can use Payflow Gateway. They can open the API and forward transactions to PayPal or can host the checkout pages of servers secured by PayPal.

Processing Fee-

| Modes of payment | Charges |

| Payflow link | $0 |

| Payflow pro (with the added feature of customizing checkout site as per the business requirement) | $25 |

PayU Payment Gateway

This payment gateway provider allows businesses in India to receive payments from local as well as international customers in multiple currencies. Transactions between merchant site and customer are secured with deep encryption thus minimising the risk of phishing or online fraud.

USP: Businesses having physical stores can streamline their online and offline payments using PayU. Payments at the physical stores can be accepted via PayU by setting up BharatQR.

Processing Fee–

2% for each transaction (exclusive of GST)

Payment Gateways for Websites

CCAvenue Payment Gateway

CCAvenue is one of the most secure payment gateways to process online transactions. It is integrated with multi-vendor and CS cart. It works equally well in both production and test modes of payment and allows CCAvenue payment response to be recorded at the admin’s end.

Once the payment is initiated, your customers can be redirected to the CCAvenue hosted site, whose look and feel can be customized to complement your company’s website.

USP: CCAvenue offers the largest portfolio of online payment options to ensure that merchants can create an outstanding payment experience for their customers.

Processing Fee-

| Mode of Payment | Charges |

| Debit cards (domestic) | 2% |

| Credit cards (domestic) | 2% |

| Net banking | 2% |

| Prepaid wallets | 2% |

| UPI | 0% |

| Debit card (international) | 3% |

| Corporate credit card | 3% |

| American express/ AMEX diners club | 4% |

| Multi-currency options | 4.99% |

All these charges are for the Start-up pro option which has no setup fee. For the Privilege plan, the setup fee is 30,000 INR. More details can be obtained by contacting the company.

HDFC Billdesk

Billdesk payment gateway is one of the oldest payment gateways in India and is frequently used by companies across sectors such as telecom, finance, retail and ecommerce. This payment integration service is best suitable for Indian companies which have to manage recurring monthly payments. For businesses which handle international payments, this online payment gateway method may not be the best option.

USP: Supports all types of payments, be it post-paid or pre-paid mobile, DTH, utility bills, insurance, or rental payments.

Processing Fee-

| Mode of payment | Charges |

| Net banking | Convenience fee of Rs. 10/- per transaction Plus Service tax as applicable on convenience fee for HDFC, ICICI, Axis, SBI and its associate banks. Convenience fee of Rs. 5/- per transaction Plus Service tax as applicable on convenience fee for other banks. |

| Credit card ((MasterCard/Visa/Amex) | Convenience fee of 0.90% on payment amount (Subject to minimum of Rs. 5/- plus service tax as applicable on convenience fee. |

| Debit Card (MasterCard/ Visa) RuPay Debit Cards ATM-cum-Debit Cards | Convenience fee of 0.75% on payment amount for value up to Rs. 2000. 0.90% of Payment amount for value above Rs. 2000.00 (Subject to minimum of Rs. 5 plus service tax as applicable on convenience fee. |

| Cash Card/Mobile Wallets | Convenience fee of 0.90% on payment amount (Subject to minimum of Rs. 5/- plus service tax as applicable on convenience fee. |

Billdesk SBI

Billdesk payment gateway provides a dedicated service to SBI account holders in India. It is one of the longest serving payment gateways in India and are used by several companies spread across various sectors such as telecom, ecommerce, finance etc.

USP: Using this payment portal, SBI customers can pay for their utility bills and carry out online transactions.

Processing Fee-

| Mode of payment | Charges |

| Net banking | Convenience fee of Rs. 10/- per transaction Plus Service tax as applicable on convenience fee for HDFC, ICICI, Axis, SBI and its associate banks. Convenience fee of Rs. 5/- per transaction Plus Service tax as applicable on convenience fee for other banks. |

| Credit card ((MasterCard/Visa/Amex) | Convenience fee of 0.90% on payment amount (Subject to minimum of Rs. 5/- plus service tax as applicable on convenience fee. |

| Debit Card (MasterCard/ Visa) RuPay Debit Cards ATM-cum-Debit Cards | Convenience fee of 0.75% on payment amount for value up to Rs. 2000. 0.90% of Payment amount for value above Rs. 2000.00 (Subject to minimum of Rs. 5 plus service tax as applicable on convenience fee. |

| Cash Card/Mobile Wallets | Convenience fee of 0.90% on payment amount (Subject to minimum of Rs. 5/- plus service tax as applicable on convenience fee. |

Paynimo

Paynimo’s secure encryption enables customers to proceed with their payments in minimal steps, allowing for superior customer experience. Merchants can set up payments using only a mobile phone without having to invest in any additional infrastructure. Paynimo provides payment links within SMS and E-mail alerts.

USP: Paynimo ensures extremely safe money transfers with two-factor authentication in compliance with PCI DSS standards.

Processing Fee- All details about fees and charges can be obtained from the official website

Stripe Payment Gateway

Stripe is one of the most popular payment gateway in recent times. Stripe services are spread across several sectors with a highly secure end to end encryption. Stripe is loaded with new features every month making the possibility of online fraud bleak and providing exceptional user experience.

Stripe further supports multi-party payments across 25 different countries, and you can also manage recurring payments easily with Stripe’s recovery tools. Further, to ensure secure payments, Stripe payment gateway encrypts all card numbers on a disk with AES-256. These decryption keys are stored across different machines to prevent any scope of the security breach.

USP: As per a report, businesses signed up with Stripe’s payment gateway register an increase of 6.7% in their revenue.

Processing Fee –

| Mode of payment | Charges |

| Mastercard and Visa card Issued in India | 2% |

| American express cards issued in India | 3.5% |

| Cards issued outside India | 3% |

| International cards | 4.3% (currency conversion will lead to additional 2% fee) |

You can also checkout some of the best Stripe alternatives.

Frequently Asked Questions (FAQs) on Payment Gateways

- What are some of the popular types of payment gateways?

a. Redirect- eg. PayPal which sees over 5 million redirected transactions in a day

b. Onsite Payment – Employed by businesses taking payments on their own servers

c. Payment offsite, checkout onsite, for example, Stripe which is used by more than 5000 companies worldwide. - How to Find the Most Secure Payment Gateway for Your Business?

You can choose most secure payment gateways for your business based on:

Payment methods utilized by customers: If you provide the payment options popular among your customers, it will not only simply payment process but also pose fewer security risks.

How much a payment gateway is charging for its service: A low fee is preferable but if more security can be obtained on a higher price, then it should be the priority.

Whether the payment gateway is PCI compliant or not: A PCI compliant payment gateway provides better encryption between buyer and merchant site.

Regions from where payment is supported: Some of the payment gateways do not facilitate payments made by international customers so businesses whose clientele is spread across the world are better off with those that can process payments made by foreign customers.

Reputation of payment gateway: How much secure a payment gateway is considered by its users? In case payment fails but amount is deducted, will there be a surety of refund to the customer? You need to ask these questions and go for those payment gateways whose reputation is well established. - What is the difference between payment gateways & payment processors?

A payment processor is responsible for transmitting transactional data to the relevant financial institution. A payment gateway is responsible for the same duties as a payment processor but in addition to these, the transaction between merchant site and buyer are authorized by the payment gateways.