Summary: Backtesting is a method traders use to evaluate the effectiveness of their trading strategies. Let’s discuss Backtesting, its advantages and limitations, and how to implement it in your trading journey.

Trading is not about blindly throwing darts at a board and hoping for the best. There are ways to test out your trades before putting your money on the line, and one of them is Backtesting.

Backtesting helps you analyze how your trading strategy will perform based on historical data. This means you can see how successful or unsuccessful your trading approach is without risking any actual money.

So, let’s dive in and discover what exactly backtesting is and how you can start implementing it into your trading routine.

Table of Contents

What is Backtesting?

Backtesting is an essential tool in modern finance that allows practitioners to test their strategies against historical market conditions. It allows them to identify potential flaws in their models and refine them effectively.

It is a process that involves analyzing historical data to see how an investment strategy would have performed if it was used in the past. It allows traders to compare the actual performance of their strategy with hypothetical performance through previous data.

Backtesting helps traders understand how effective their strategy is and whether it would have been profitable in the past.

What is Backtesting in Trading?

Backtesting is a standard trading method used to analyze past strategies and investment choices. It uses historical data to see how effective and potentially profitable those strategies would have been. Backtesting aims at finding patterns and trends that can guide future trading choices.

Basically, backtesting is like a simulation that tries to recreate past market conditions to test different trading strategies. Traders use specialized software to input specific rules or parameters for buying and selling assets during the backtesting process.

Types of Backtesting Strategies

Here are the various types of backtesting strategies that traders employ to gain valuable insights and enhance their trading edge.

- Historical Backtesting: This is a fundamental approach to Backtesting. It involves testing a trading strategy using past data. Trades are simulated based on historical market conditions, and the strategy’s results are analyzed.

- Walk-Forward Analysis: This method combines both in-sample and out-of-sample testing. The historical data is divided into segments representing specific periods. The strategy is first tested on the in-sample data and then applied to the subsequent out-of-sample data. This process is repeated with new data, allowing for a dynamic evaluation of the strategy’s performance.

- Event-Driven Backtesting: This approach evaluates a strategy’s performance based on specific events or triggers. The strategy is designed to react to certain events or market conditions, and the backtesting process assesses how well it performs in those scenarios.

- Multiple Time Frame Backtesting: A strategy is tested across different timeframes to assess its performance under varying market conditions. This helps determine if the strategy works consistently across different time horizons or is more effective in specific timeframes.

- Monte Carlo Simulation: This involves generating multiple randomized scenarios based on historical data to assess a strategy’s performance in different market conditions. It provides a broader understanding of the strategy’s robustness by considering various potential outcomes.

- Sensitivity Analysis: In this method, specific parameters or variables within a strategy are adjusted to observe how changes affect its performance. By varying inputs, one can evaluate a strategy’s sensitivity to different market conditions and its viability across various scenarios.

Suggested Read: Top Backtesting Software for NSE Stocks and Options in India

Why Backtest Trading Strategy?

Backtesting can provide valuable insights into how a strategy would have performed in the past, which can help traders make more informed decisions about its future potential.

One of the primary benefits of Backtesting is that it allows traders to identify weaknesses in their strategies before they risk real money. By reading past performance, traders can see which trades were profitable and which were not. It helps them to fine-tune their approach and increase their chances of success.

Backtesting also allows traders to test different variations of their strategy, such as changing entry or exit points or adjusting risk management parameters.

How to Backtest a Trading Strategy?

Backtesting a trading strategy is a crucial step in assessing its potential profitability and reliability. Explore two distinct approaches to backtesting: manual backtesting and software-based backtesting. Each method offers its own advantages and considerations, providing traders with valuable insights into the effectiveness of their trading strategies.

How to Manually Backtest a Trading Strategy?

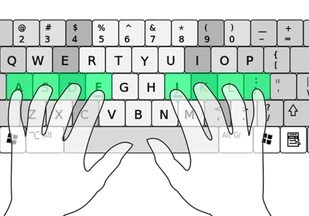

To manually backtest a trading strategy, you will need historical price data for the assets or markets you intend to trade in. You can get this data online from your broker or other third-party vendors like Moneycontrol or Investing.com. Once you have access to the historical price data, you can start by defining your entry and exit rules based on your strategy’s parameters.

Next, load the historical price data into a spreadsheet and apply your entry and exit rules to each bar in the dataset. You can record all of your trades, including entry and exit prices, stop-loss levels, take-profit targets, and any other relevant information that will help you analyze your performance.

Suggested Read: Intraday Trading Indicators for Option and Equity Trading

How to Backtest a Trading Strategy Using Software?

The exact techniques for backtesting a trading strategy vary from software to software. However, common procedures are as follows:

- Choose the desired financial market and the specific time period you want to analyze.

- Configure the parameters of your trading strategy within the software. This includes setting initial capital, portfolio size, profit targets, stop-loss levels, and any other relevant instructions.

- Initiate the backtest by running the software. It will simulate trades based on the defined strategy using historical data.

- Evaluate the results of the backtest. Examine factors such as profitability, drawdowns, and overall performance. If the strategy did not perform as expected, consider using the optimization features offered by the software to refine and improve it.

Some Popular Backtesting Software are: TradingView, MetaTrader 4, AmiBroker etc.

Example

Let’s understand backtesting with the help of an example. Roy is a trader and looking to maximize his profit potential.

Roy is conducting a thorough analysis of a trading strategy that involves taking short positions when the short-term Moving Average (MA) falls below the long-term MA. He believes that this particular approach has the potential to generate higher profits compared to the existing strategy. To assess its effectiveness, Roy uses specialized software designed for Backtesting.

To begin the process, Roy chooses to focus on the equity market. He then proceeds to input the desired backtest timeframe, specifically from March 1, 2017, to March 1, 2023.

Additionally, he specifies the profit target and stop-loss instructions to refine the parameters of his strategy. After ensuring all the necessary inputs are accurately entered, he initiates the backtest and meticulously examines the resulting data.

By using backtesting, Roy gained insight into the historical performance of his strategy over the chosen timeframe. If the backtest indicated higher profits, Roy could consider implementing his new approach with more confidence.

Secondly, backtesting enabled Roy to identify potential flaws or weaknesses in his strategy. And, this analysis helped him refine and fine-tune his approach, potentially leading to better decision-making and improved profitability in future trades.

Additionally, backtesting allowed Roy to validate his assumptions and hypotheses about the market. This knowledge assisted him in making more informed trading decisions.

Suggested Read: Intraday Trading Strategies for Options and Equity

Benefits of Backtesting

Let’s take a look into the advantages of backtesting and explore how it can shape your investment journey. Here are some of the benefits of Backtesting that need to be considered:

- Identifies potential flaws in trading strategies

- Helps traders understand the historical performance of their strategy

- Provides a way to optimize and improve trading strategies

- Helps traders make better decisions based on past data

- Reduces emotional bias in trading by providing data-driven insights

- Increases confidence in trading strategies and overall success rate

Risks of Backtesting

While backtesting can provide valuable insights and assist in decision-making, it is important to acknowledge the limitations of backtesting. Understanding these boundaries is crucial to ensure the accuracy and reliability of our investment strategies:

- Past and historical data cannot always predict the future. So, accuracy isn’t always guaranteed.

- Previous data may be biased due to a significant market incident or unusually optimistic feelings.

- Strategies successful in bullish markets may not be effective during bearish conditions, and vice versa.

- A successful trading strategy in forex may not yield the same results when applied to shares due to market differences.

- Models trained on limited datasets may fail to consider the diverse range of market conditions.

Suggested Read: Best Automated Algorithmic Trading Software in India

Which is the Best Backtest Trading Strategy?

Traders have unique strategies that vary based on their goals, risk tolerance, preferred markets, and experience.

A popular backtesting approach is manual intraday Backtesting, which even beginners can try. By examining past trades on technical charts, traders can gain insight into price movements and potential profits or losses.

One more approach that a trader can try is combining backtesting with forward testing. The trades are only simulated on paper when doing forward testing, so no real money is involved. Every trade is documented, including the profits and losses from using the trading system. Additionally, forward testing uses live data.

Some Backtesting Tips from Experts

Now that you have understood what Backtesting is? Types of Backtesting, and backtesting strategies, here are some valuable backtesting tips from experts in the field to help you improve your trading strategy evaluation and decision-making process.

- Use multiple time frames for backtesting to get a comprehensive view of market behavior.

- Avoid overfitting by using meaningful data and not just fitting the strategy to past performance.

- Be aware of survivorship bias and include delisted or bankrupt companies in your data set.

- Use realistic transaction costs and slippage in your Backtesting to accurately reflect trading expenses.

- Test your strategy on out-of-sample data to see how it performs in unseen market conditions.

- Keep a detailed log of all trades and adjustments made during backtesting to review and improve the strategy over time.

Conclusion

Backtesting is a valuable tool for traders to test and refine their trading strategies. However, to successfully backtest a strategy, it is important to define clear entry and exit criteria, use accurate data, and avoid overfitting.

With practice and patience, the right tools, and knowledge, any trader can incorporate backtesting into their trading routine and increase their chances of success in the markets.

Suggested Read: Professional Options Trading Software in India

FAQs

- What is backtesting?

Backtesting is a process of testing a trading strategy with historical market data. It helps to assess the potential effectiveness and performance of the strategy.

- What is backtesting a trading strategy?

Backtesting a trading strategy involves applying a set of predefined rules to historical market data to determine how the strategy would have performed in the past.

- Is backtesting useful?

Yes, backtesting is useful. It allows traders to assess the viability and potential profitability of a trading strategy before risking real money in the market.

- Does Backtesting really work?

Backtesting can provide valuable insights and help refine trading strategies, but it's important to recognize that real market conditions may differ, so backtesting works, but it's not a foolproof predictor of future performance.

- How do you backtest a trading strategy?

To backtest a trading strategy, you can gather historical market data, define the strategy's entry and exit rules, and then apply these rules to past data to see how the strategy would have performed. You can also use software like MetaTrader 4, TradingView, etc.

- What is the best way to backtest trading strategies?

The best way to backtest a trading strategy is to use software like AmiBroker, which simulates the actual market environment. Some software programs even allow you to adjust parameters such as risk tolerance, leverage, and position size.

- Why does Backtesting not work?

Backtesting may not work perfectly due to several factors, such as the inability to simulate real market conditions accurately, reliance on historical data, and the potential for curve fitting or over-optimization.

- How many trades are good for Backtesting?

The number of trades suitable for Backtesting depends on the specific strategy and market. Generally, 500 – 750 trades are considered as good for Backtesting.

- How accurate is backtesting?

Backtesting is a powerful strategy for traders. However, it is not necessarily the most precise method of determining a trading system's performance. Sometimes techniques that worked effectively in the past may not work well now.

- What is the most accurate trading strategy?

There is no “most accurate” trading strategy, as market conditions and dynamics constantly change. Different strategies work best in different situations. However, some frequently used strategies are manual intraday Backtesting and forward testing.

- What strategy do most traders use?

The most popular strategy among traders is Range trading, Breakout trading, and Reversal trading.