Summary: AI trading platforms have made it easier for traders to quickly identify profitable trading opportunities and execute the same within the software. What software or tools can you use for the same? Get insights on this in the article below!

Nowadays, AI has also paved its way in stock trading. This has made it easier for traders to analyze the stock market and predict the profitable opportunities as compared to manual trading. Moreover, using AI stock trading software helps traders to improve their buying and selling procedures and bid on profitable stocks.

More and more traders are shifting to AI based trading software as they can neutrally process the stock data and gain actionable insights on stocks. Keep on reading to learn more about AI trading below.

Table of Contents

Why Use AI Bots and Software for Stock Trading?

Using AI bots and software for stock trading can help a lot with stock trading such as finding profitable stocks, backtesting trading strategies, performing simulated trading, etc. You can also use them for several purposes such as:

- Automatically sends stock buying and selling alerts to traders

- Forecasts future trading opportunities by analyzing historical trading data.

- Does simulating trading without investing money.

- Offers access to a library of successful trading strategies.

- Identifies trading patterns to improve trading strategies

- Recognizes and finds trading risks by analyzing historical data, technical indicators, etc.

- Processing large data sets quickly to gain actionable insights.

11 Best AI Stock Trading Software, Apps and Bots for Stock Market

- MetaStock

- Trade Ideas

- TrendSpider

- StockHero

- Blackboxstocks

- EquBot

- Signal Stack

- Scanz

- Tickeron

- VectorVest

- Algoriz

You can find diverse types of AI software, bots, and apps for stock trading. They have made it easier to analyze the stock market and identify the most profitable trading assets quickly. Here are some of the best software, apps, and bots you can use for profitable trading.

MetaStock: Best for AI Stock Backtesting and Forecasting

MetaStock is an AI-based charting tool that helps traders in analyzing various stock markets. The tool utilizes technical analysis to find the best securities to invest in via a methodical and systematic approach. With it, you can create and view charts for stocks, indices, bonds, currencies, etc.

MetaStock Features

- Back tests trading strategies

- Forecasts future stock prices depending on past events

- Provides 150 + indicators to identify trading trends

- Offers expert advice on the trading chart based on popular trading strategies

- Monitors various option chains for Plot risk and sentiment

OS MetaStock: Windows

Pros and Cons of MetaStock

- You can also create QuoteLists up to 600 symbols.

- It also supports intraday trading.

- It takes a lot of time to get familiar with the software.

Free Trial of MetaStock: Available for 30 days

MetaStock Pricing: No free plan available | Paid plan starts from INR 41,254.48

Trade Ideas: Best for AI-bases Stock Trading

Trade Ideas is an AI trading platform that enables users to study the stock market and provide recommendations for profitable trading opportunities. With it, you can scan stocks in real-time, perform trading analysis, analyze market risks, customize trading strategies, etc.

Features of Trade Ideas

- Creates trading strategies and executes them

- Provides real-time stock racing

- Runs AI based investment algorithms to find trading opportunities

- Trades stocks in any trading chart with a single click

- Supports simulated trading without any investment

Trade Ideas OS: Windows, Mac, and Linux

Pros and Cons of Trade Ideas

- Supports event based back testing to provide score on how trading scans, entry signals, trading plan, etc., perform.

- Provides exit signals based on different risk management for intraday trade management

- No mobile application available

Free Trial of Trade Ideas: No free trial available

Pricing of Trade Ideas: No free plan available | Paid plan starts from INR 9,750.27/month

TrendSpider: Best for Automated Technical Analysis

TrendSpider is technical analysis software that helps traders to make better trading decisions. It offers tools for generating strategies, analyzing trading opportunities, scanning markets, visualizing trading charts, etc.

With this AI trading software, you can also run backtests on different class assets via historical data.

Features of TrendSpider

- Creates and customizes trading strategies

- Generates live trading bots without any coding

- Presents various strategies directly in charts

- Supports 55,000+ liquid tradable instruments

- Provides real-time data on crypto, stocks, etc.

- Convert back tested strategies directly into live trading bots code-free

TrendSpider OS: Web based and supported all major operating systems

Pros and Cons of TrendSpider

- Automatically performs technical analysis of market data to find opportunities.

- Adds trends and indicators from different timeframes in one chart.

- You can only use it in a single browser at a time.

TrendSpider Free Trial: Available for 7 days

Pricing of TrendSpider: No free plan available| Paid plan starts from INR 2,420.31/month

StockHero: Best for Creating AI Stock Trading Bots

StockHero AI stock trading platform is used to create automated trading bots for different stocks as per your convenience.

The bots are created without any code to perform tasks like back testing strategies, trading stocks, getting recommendations, setting up trading conditions, and so on. You can use it through web browsers and mobile apps.

StockHero Features

- Offers unlimited backtesting of trading strategies

- Trades different stocks through a single click

- Provides an aggregate portfolio of bots’ performance

- Deploys bots live in paper trading for testing its real-life performance

- Executes both short and long trading strategies

- Integrates with TradingView to let bots to buy and sell stocks

StockHero OS: Web based and supported all major operating systems including android and iOS

Pros and Cons of StockHero

- You can access all its features from your mobile due to its responsive designs.

- It lets you rent a trading bot from a marketplace instead of creating one.

- Features are not suitable for advanced trading.

- Offers limited trading indicators for technical analyses

Free Trial of StockHero: Available for 14 days

Pricing of StockHero: No free plan available | Paid plan starts from INR 412.92/month

Blackboxstocks: Best for Day Trading

Blackboxstocks is the perfect trading platform that provides features for trade execution, analysis, community chat, etc., in a single solution.

This solution can help with scanning stocks to find opportunities, discovering trends in the market, collaborating with traders in the community, checking Opening Range Breakout for stocks, etc.

BlackBoxStocks Features

- Offers several grade indicators and charting libraries for trading

- Provides Options Flow Scanner that provides market insights via advanced algorithms

- Offers multiple filters to filter out specific market data

- Trades securities privately with dark pools

- Provides Proprietary Volatility Indicator to measure all buy and sell opportunities on stocks in real-time.

- Offers the Alert Log’s Volatility tab for sorting and finding information

OS of BlackBoxStocks: Web based and supported all major operating systems including android and iOS.

Pros and Cons of BlackBoxStocks

- You can easily share your trading strategies, charts, etc., in the community.

- It offers a multi-chart system to view stocks from different industries.

- Beginner traders find it difficult to use this software

Free Trial of BlackBoxStocks: Not available

BlackBoxStocks Pricing: No free plan available | Paid plan starts from INR 8,271.50/month

EquBot: Best for Creating Investment Portfolios

EquBot with IBM Watson is an investment platform powered by AI to help institutional investors to make good investment decisions through Portfolios as a Service (PaaS).

The platform access data in a short time to create custom and explainable investment portfolios in bulk. EquBot helps in designing portfolios that can help you reflect the investment ideas for different investment assets.

Features of EquBot

- Provides risk data for different trading assets including stocks, ETFs, etc.

- Automatically ranks and screens different securities depending on investment portfolio criteria

- Offers machine learning for optimizing the portfolio for analyzing and reducing risk.

- Identifies new risk patterns for trading markets to mitigate risks

- Backtests the portfolio strategy by replicating an information environment.

EquBot OS: SaaS based

Pros and Cons of EquBot

- It lets you present the investment ideas in the trading market via portfolios as a service and as the official index.

- Users have reported that scanning securities takes longer than expected.

EquBot Free Trial: Not available

Pricing of EquBot: Price is available on its official website

Signal Stack: Best for Automating Trading Strategies

SignalStack is an AI stock trading that helps traders in converting trading alerts from different platforms into live orders within the brokerage account automatically.

To use it, you need to create the account and connect the brokerage account in it. Once done, all the trading alerts will be automatically converted into orders.

Features of Signal Stack

- Customizes and automates technical analysis for trading

- Easily integrates with multiple brokers including Bybit, Optimus Futures, BingX, etc.

- Automatically converts trading signals into orders for eliminate slippage situations

- Connects to any broker’s account directly without any code

- Provides WebHook alerts to easily connect with third party trading platforms.

Signal Stack OS: Web based and supported all major operating systems

Pros and Cons of Signal Stack

- It maintains a complete log of all the interactions with the brokers.

- You get 99.99% system uptime with it.

- Sometimes it shows errors during technical analysis.

Signal Stack Free Trial: Not available

Pricing of Signal Stack: Offers 25 signals for free | After that, it charges INR 48.82

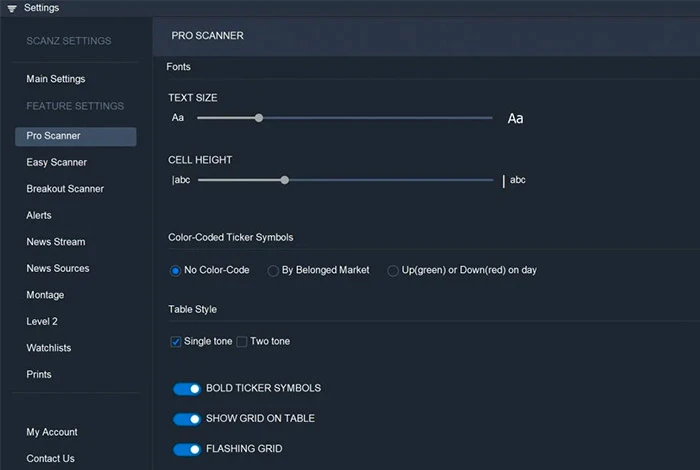

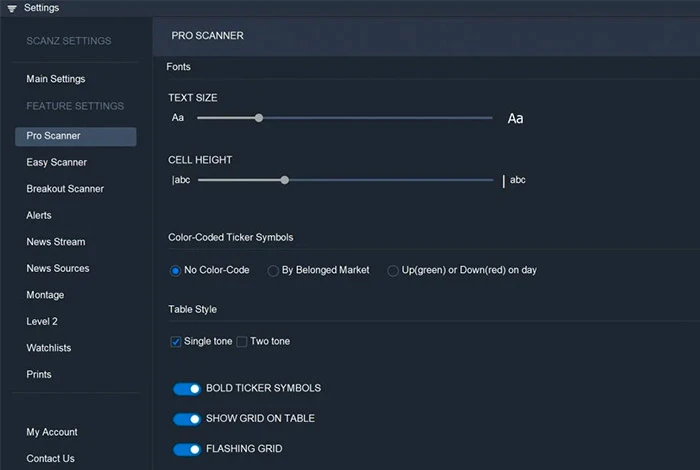

Scanz: Best for Scanning Stock Markets Automatically

Scanz is a real-time stock screening software designed especially for data traders to identify endless daily trading opportunities.

This artificial intelligence trading software helps in identifying profitable stocks, developing customized notifications and alerts, viewing complete trading charts, etc.

Scanz Features

- Create customizable stocks scan with 100+ price, volume, and technical variables

- Integrates with multiple brokers directly from the platform

- Scans trading markets individually and together

- Provides auto sorting tools to help you identify the best trading opportunities

- Offers ETF (Exchange Traded Fund) scanner to find ETF opportunities in various sectors

Scanz OS: Web based and supported all major operating systems

Pros and Cons of Scanz

- It lets you filter the stock results by foreign stocks, preferred stocks, regular stocks, etc.

- It provides trading breakout signals in real-time.

- Pre-built scans for stocks are not available within the software.

- Users need to pay extra for viewing OTC market data

Free Trial of Scanz: Available for 7 days

Pricing of Scanz: Offers a single plan starting from INR 13,984.23/month

Tickeron: Best for Swing and Day Trading

Tickeron is an AI trading platform that provides users with the best trading tools for trading and lets them create their portfolio. With AI, it generates different trading ideas based on pattern recognition and identifies the best asset allocation models.

It also offers several algorithms to easily create investment portfolios. Further, it’s second-generation AI robots lets you adjust your trade balance to complement the brokerage account.

Tickeron Features

- Identifies stock exit and entry points with AI trend module.

- Screens stocks to find the profitable deals

- Supports paper trading

- Provides latest news related to stocks in real time

- Offers 100+ backtested algorithms for trading

- Provides AI robots to buy and sell trades

- Provides real-time alerts for open day trading opportunities

OS of Tickeron: Web based and supported all major operating systems including android and iOS

Pros and Cons of Tickeron

- It lets you get live quotes for different stocks and financial markets.

- With it, you can also invest in crypto and forex as well.

- Users find it difficult to navigate through functions as too many options are available on a single screen.

- It has limited customizing chart options available.

Tickeron Free Trial: Available for 14 days

Pricing of Tickeron: Free plan available for swing trading | Paid plan starts from INR 7,431.21/month

VectorVest: Best for AI Stock Analysis and Portfolio Management

VectorVest is a stock analysis and portfolio management software enabling traders to analyze, rank and also graph almost 1800+ stocks every day.

Further, it also provides a buy, sell, and hold rating for different stocks. VectorVest also provides guidance on the trading market to learn the perfect time to sell and buy stocks.

Features of VectorVest

- Provides tested trading plans to help you invest better.

- Provides regular and extended market timing signals

- Screens stocks to identify the profitable stocks

- Performs technical and fundamental analysis to provide recommendations

- Offers 30 metrics and categories to analyze, sort, rank stocks with top industry charting

VectorVest OS: Web based and supported all major operating systems including android and iOS

Pros and Cons of VectorVest

- With it, you can create and manage investment portfolios.

- It offers various videos and tutorials to get familiar with the software.

- You cannot use it directly on the web.

- It offers limited chart indicators

Free Trial of VectorVest: Available for 30 days

VectorVest Pricing: No free plan available | Paid plan starts from INR 5,701.40/month

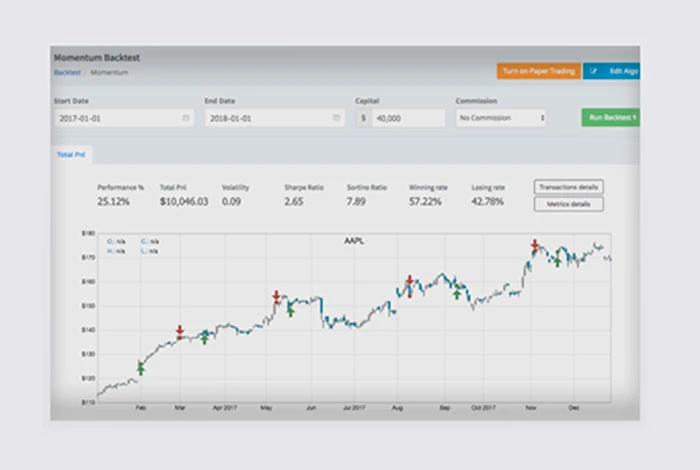

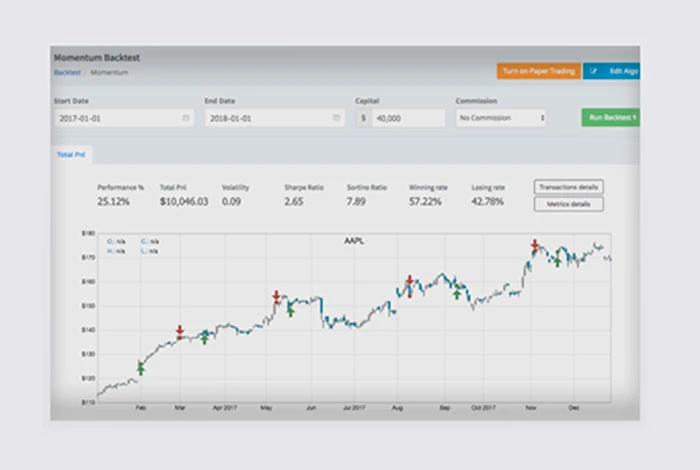

Algoriz: Best for Developing Trading Strategies

Algoriz is a AI-based trading solution to easily develop, backtest and automate different trading strategies for multiple equities, cryptocurrencies, etc. With it, you can connect with different broker accounts to trade different stocks.

Algoriz Features

- Develops and tests trading strategies with simulated matching engine.

- Supports trading of different cryptocurrencies including Bitcoin, Ethereum, and XRP.

- Connects the broker account within the Algoriz for automating trading algorithms

- Supports paper trading

- Offers screeners to screen different stocks and find the profitable opportunities

OS of Algoriz: Web based and supported all major operating systems

Pros and Cons of Algoriz

- The solution supports almost 10000 tested trading strategies.

- You can easily connect with multiple data vendors.

- Backtesting period is only 5 years even in the paid plan.

Algoriz Free Trial: Available

Pricing of Algoriz: Free plan available | Paid plan starts from INR 2,397.85/month

Risks and Benefits of Artificial Intelligence Stock Trading

Benefits of AI Stock Trading

There are plenty of benefits of AI stock trading like quickly analyzing market data, finding trading patterns, creating trading charts, etc. Some other benefits of AI stock trading include-

- Makes it easier to backtest trading strategies

- Automatically presents the technical analysis of stock markets

- Detects and identifies patterns of trading

- Helps traders to identify biggest trading opportunities via bots

- AI helps to generate accurate trading charts

Risks of AI Stock Trading

AI stock trading has become a popular way to analyze financial markets and identify opportunities. However, it also comes with some risks such as-

- Machine learning trading algorithms could be less auditable and predictable that might create market volatility.

- AI trading requires technical expertise to understand the complex trading algorithms that might be difficult for new traders.

- The AI models are generally trained on specific amounts of data to analyze markets and make predictions. Therefore, the models might find it difficult to process unknown market data.

Conclusion: Select Best AI Stock Trading Software

AI trading tools have become an asset for traders to make better decisions for selling and buying different financial instruments like bonds and stocks. From analyzing market data, identifying trading opportunities to executing stocks, everything can be completed in a short span.

FAQs

How can AI be used for stock trading?

Yes, AI can be used for trading different types of stocks via sentiment analysis and complex algorithmic predictions for analyzing different data points and providing trading opportunities.

What is AI stock trading?

AI stock trading uses artificial intelligence technology and financial markets historical data sets for analyzing stock data, predict trades, provide trading opportunities, etc. This helps in reducing trading risks and achieve increased ROI.

How does AI stock trading work?

Most AI stock trading software utilizes machine learning and sentiment analysis to analyze various data points in trading and provide profitable trading opportunities.

What are the benefits of AI stock trading?

There are several benefits of using AI stock trading such as accurate analysis of stock market, providing stock predictions, identifying trading patterns, and so on.

Is AI stock trading legal?

Yes, algorithmic and AI-based trading is legal in India.

Can AI trade stocks?

Yes, AI is used for stock trading and investment because of its capability to process and analyze big data sets in real time to help traders to find the best trading opportunities.

How to use AI for stock trading?

To leverage AI technology for stock trading, you can use AI-based software. Within the software, you can configure the trading settings and enable AI stock trading. Once done, the AI will automatically trade stocks, study trading charts, etc., to help you find the best trading opportunities.

Is there an AI that can trade stocks?

Yes, there are multiple types of AI software available that can perform technical analysis to help you find the best trading opportunities. Some of the best tools you can consider include Signal Stack, Scanz, TrendSpider, Tickeron, etc.

Does AI trading software really work?

Yes, AI trading software actually works to find trading opportunities. The software will run AI-based algorithms to identify trading patterns, profitable opportunities, and also stocks rate in real-time.

How much is AI trading software?

The cost of any AI trading software depends on the types of trading functions it offers to customers. However, on average, the basic AI trading software price starts from INR 4,131.37/ month.

Do AI trading bots work?

Yes, Ai bots can be used for trading, however, their performance in the future cannot be guaranteed. The AI algorithm might work for a while, but the stock market dynamic, businesses, investor sentiments keep on changing. Therefore, you need to adopt different AI strategies in specific trading situations.